So we’ve covered benefits, budgeting, and savings. Now we are on to the fun part. Putting that hard-earned money to work for you.

IMPORTANT NOTE! Investing involves risk. Usually, the higher the risk, the higher the return. You COULD lose money. Keep that in mind before taking part in any investments.

Sure, we’d all love to get an 8% return in a cozy, no-risk savings account like they did in the 80’s. That’s just not the case anymore. (Of course, they also had to pay 18% interest on mortgages for their house!)

If you want your money to grow, you have to invest in something other than savings accounts.

Most people go through life working to make money. What you need to do is to get that money working for you. QUIT TRADING YOUR HOURS FOR DOLLARS! The way you do that is by investing in things that will make you money. These are assets. Most people like to spend their extra money on trucks, cars, snowmobiles, ATVs, etc. Our students just LOVE spending their money on these things. These are NOT assets. Unless you can use one of these to make more money than they cost, they are liabilities.

These liabilities are the things that WILL cost you your financial stability, security, and freedom!

There are a variety of assets that you could purchase.

- A business

- Real Estate

- Stocks

- Bonds

All of these assets have their pros and cons.

Business

As teachers, most of us probably don’t have the time to start our own full-time business, but what we can do is start a side business, or as the T.A. likes to call it, a side-hustle. There are a variety of side-hustles that you can invest in. Things like Etsy, a website, Amazon fulfillment, etc… The key with these side-hustles is that you want them to make you money with some up-front work, and then earn income on their own. Sure, you could start a landscaping or lawn mowing business in the summer, but there again, you are working for your money! That defeats the purpose of what we are trying to do.

You could also invest in a start-up business or one that is already established. Maybe your friend needs some start-up capital for their new clothing boutique. You could be an angel investor in their company. Just be sure to do your due diligence on their business plan. Businesses like these can cost you your entire investment.

Even though a business can grow and create great wealth, the T.A. and I are kind of “meh” on businesses as an investment because they do require a lot of work and time to start.

Real Estate

Since the beginning of time, real estate has been a symbol of wealth and power. All the way back to early man, they would fight for the right to hunting grounds and natural resources that the land provided. Today, people use real estate to grow their wealth through rental or commercial properties. This type of investment can be doubly powerful. On one hand, you are collecting monthly income through rent from your tenants. On the other hand, the value of your property is increasing through appreciation. This can grow wealth rapidly. You also have the ability to use leverage to grow your wealth. You can take your down payment of $25,000 and collect rent payments on a property that is worth $100,000. This ability to leverage is how you can grow your real estate portfolio very quickly.

As with a business, real estate can be very a lot of work and very time consuming. There are options such as “turnkey” investing, where you buy a property from a “turnkey” company who will have the property move-in ready and even manage it for you. This “passive” real estate investing works as well, but definitely not as quickly as “active” real estate investing.

We will have a separate post on this in the future as the T.A. and I are discussing getting into this area. Hopefully we will be able to make a case study post on this someday.

Stocks

Stocks, or equities, are shares of ownership in a publicly traded company. If you have a retirement account (which you should!), you will already own some stock. Stocks are traded on the exchange and come in a variety of forms. You make money on stock when the value of that stock increases over time. You can also make money on that stock if they pay out dividends. A dividend is a share of that businesses profit that they pay out per share. Some companies pay them out once a year. Most of them pay on a quarterly basis. Just like real estate, you can make money different ways with stocks.

Now when it comes to purchasing stocks, you can purchase stocks of individual companies, or you can purchase them bundled together. These bundles come in different forms and have their own advantages and disadvantages. ETF’s, mutual funds, and index funds are the most common. We won’t go too deep down the rabbit hole on stocks in this post. More will come in this area. JL Collins has a tremendous site for knowledge on this subject.

Bonds

Bonds are a loan made by a corporation or government entity that is bought by an investor (you). Bonds will pay an agreed upon rate when they are purchased and held for a stated amount of time. Bonds are considered fixed because the rates don’t change after you purchase them. They are usually very safe investments compared with stocks. (unless you are buying bonds from shady companies). Bonds will usually have a rating associated with them. Since these are usually “safe” investments, they won’t give you as good of returns over time as stocks will.

Our next post will focus on Investing Accounts. (Link)

Keep stacking!

Minnesota TRA Full Retirement Age: What Age 65 Really Means

Most Minnesota teachers hear terms like Rule of 90 or 60/30 long

Minnesota TRA Early Retirement Reduction Explained

Teaching in Minnesota has become more demanding in recent years. Expectations are

Minnesota TRA Tier I vs Tier II Explained

Minnesota Rule of 90: Complete Guide for TRA Tier I Teachers

Minnesota’s Rule of 90 is one of the most consequential retirement provisions

How the Minnesota TRA Pension Is Calculated (Formula, High-5, and Real Examples)

Most Minnesota teachers know they will receive a TRA pension through the

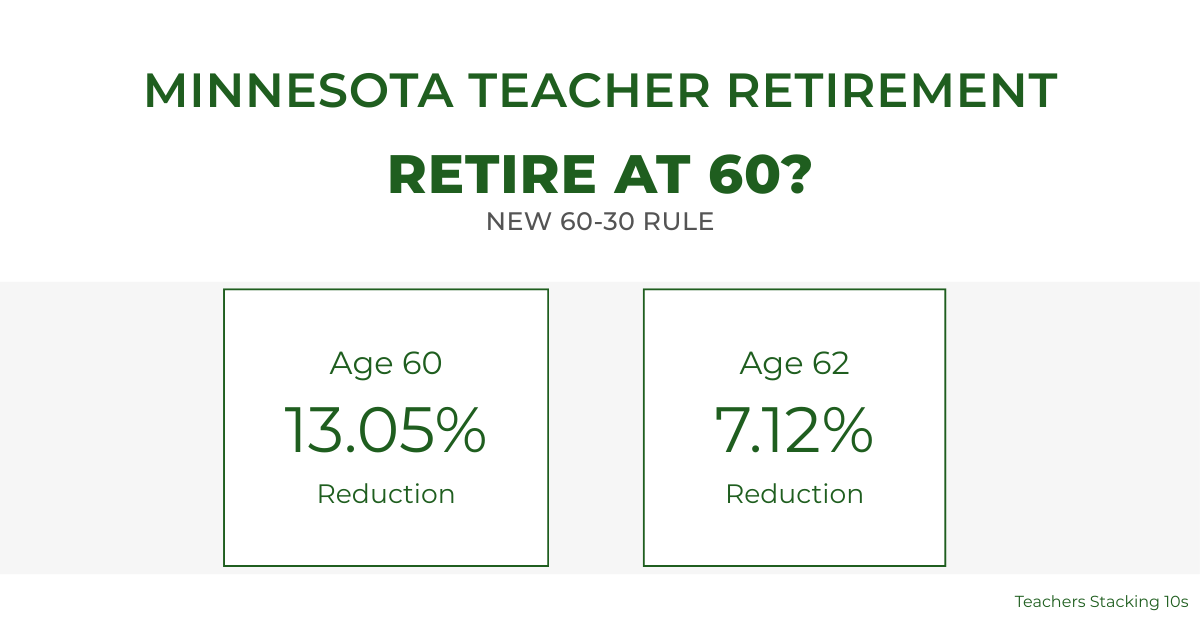

Minnesota Teacher Retirement at 60: Understanding the Enhanced 60/30 Rule

For years, Minnesota teacher retirement at age 60 was financially unrealistic for

Leave a Reply

You must be logged in to post a comment.