So Where Do I Buy Stocks and Bonds?

Now that we’ve convinced you that you need to put your money to work, and you’ve decided that you need to use stocks (and bonds) to grow your wealth and improve your financial future, the question is where?

We will be looking at 5 different types of accounts that you can purchase these things.

Retirement Accounts

The first group of accounts are all various types of retirement accounts. EVERYONE should have at least one of these accounts RIGHT NOW! My 16-year-old daughter already has a retirement account! The longer your money is in the market, the more time it has to grow….

“But Professor, I have a teacher pension. I don’t need a retirement account.”

Actually, yes you do. Many public pensions in the U.S. are currently under attack due to underfunding by state governments. It’s also the American way to take away things from others that you have lost or never had. Private sector workers have seen their pensions dropped over the last 20 years and instead of fighting to get them back, politicians have them focused on making sure that public sector employees lose theirs too! Idiots….

But I digress.. Your pension right now might look wonderful, but it definitely could change by the time you are of retirement age. And let’s be honest, full retirement age in Minnesota is 66. There is no way in hell that I am still going to be working with kids at that age. I want the ability to retire when I am ready to retire, and retirement accounts will allow you to do that!

Now most people’s biggest gripe with retirement accounts is that you CANNOT withdraw funds from some of them before age 59 ½ without incurring a 10% penalty. There are some exceptions to this rule that we will cover below.

In all seriousness, as a teacher, you have access to more retirement accounts than most other professions.

Retirement Accounts

403(b)

The 403(b) is the public employee equivalent of the 401(k) that you’ve probably heard about. This account is a “tax-deferred” account. It means that you are putting money into this account before current taxes are removed. Your money then grows TAX-FREE for the next 25 years! When you “retire” and begin to withdraw money from this account, it will be counted as income and taxed accordingly.

One of the most important aspects of the 403(b) is that many districts will “match” money that you put into your 403(b). For example in our district, they will match 100% of your contributions up to $700/year. That’s a 100% return on your $700 investment!! You can’t get that kind of guaranteed return anywhere else!

The combined contribution limit for all 403(b) accounts for 2019 is $19,000. This does not include any monies that your district includes.

The biggest con of the 403(b) account is that you are limited in your investment choices to the ones that the servicer your school uses provides. You don’t get to just pick and choose what you are buying.

Roth 403(b)

This account might sound like a regular 403(b), but it is very different. Whereas a 403(b) is funded with pre-tax money, a Roth is funded with after tax money. So you pay Roth taxes up front, your money grows tax-free, and then you pay NO taxes when you withdraw the money. Later in the article, we will analyze which accounts you should be contributing to.

The combined contribution limit for all 403(b) accounts for 2019 is $19,000. This does not include any monies that your district includes. The same rules about investment products apply to the Roth as the traditional 403(b).

457(b) and Roth 457(b)

The 457(b) plans are very similar to 403(b) plans. They have the same contribution limits as the 403(b), but they separate from those limits. This means that an employee may contribute $19,000 to a 403(b) AND $19,000 to a 457(b). So this means that you could contribute $38,000/year to your retirement. Let’s be honest, ain’t a damn one of us teachers able to afford that. Hell, $38,000 is more than you can make in our district for the first couple of years of teaching. Now, if you are lucky and married a “sugar daddy/momma” then you could definitely go for it, but then why do you even need us?

Let’s get to the biggest advantage of the 457(b) plans. Whereas you will be hit with a 10% early withdrawal penalty if you take out funds before age 59 ½ from your 403(b) plans, you may withdraw your 457(b) funds at any time after you retire without early withdrawal penalties! Yahtzee!!! This is your golden ticket if you hope to retire early!

Traditional and Roth IRA

These accounts are NOT associated with your school. These are accounts that you would open on your own with a brokerage of your choosing. The nice thing about these accounts is that YOU have total control on deciding where to put your money. You are not limited to the investments that your 403(b) servicer provides. You just need to choose a brokerage to open your IRA in. Our personal recommendation is Vanguard, but there are plenty of other good brokerages out there. Since these are so nice to have, of course the government limits how much you can contribute. The max combined contribution is $6,000 for 2019. This is much below the $19,000 contribution limit for your 403(b). Remember, the financial industry has a lot (of money) to lose if you are in charge of your own money!

Final Word

The majority of people we talk with are scared and nervous about investing their own money. The financial industry has PURPOSELY made investing seem difficult. That way you feel like you need them to invest your money, and they can charge you fees to invest that money for you. You might like your 403(b) rep. He or she might be a great person, but remember, their JOB is to make money off of you whether your money grows or not! Investing might seem difficult, but if the TA and I can do it, anyone can.

Keep Stackin!

Minnesota TRA Full Retirement Age: What Age 65 Really Means

Most Minnesota teachers hear terms like Rule of 90 or 60/30 long

Minnesota TRA Early Retirement Reduction Explained

Teaching in Minnesota has become more demanding in recent years. Expectations are

Minnesota TRA Tier I vs Tier II Explained

Minnesota Rule of 90: Complete Guide for TRA Tier I Teachers

Minnesota’s Rule of 90 is one of the most consequential retirement provisions

How the Minnesota TRA Pension Is Calculated (Formula, High-5, and Real Examples)

Most Minnesota teachers know they will receive a TRA pension through the

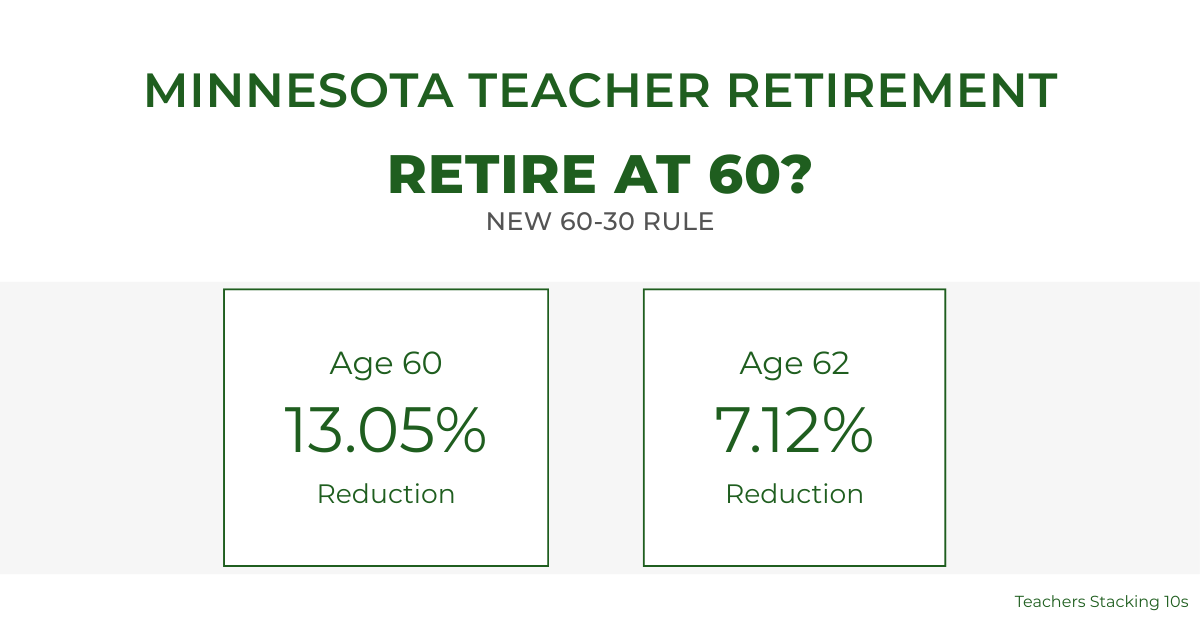

Minnesota Teacher Retirement at 60: Understanding the Enhanced 60/30 Rule

For years, Minnesota teacher retirement at age 60 was financially unrealistic for

Leave a Reply

You must be logged in to post a comment.