Or, more accurately… What the Hell is a pension?

If you are like me, you’ve always thought that a pension is some kind of retirement plan the government gives you after your service. It is one of those things that you hear a lot about but it can quickly become overwhelming trying to figure out exactly what a pension is and what the government is going to be paying you after you retire.

New to Minnesota teacher retirement planning? Start with our complete Teacher Finances 101 guide.

(A QUICK DISCLAIMER. Pension plans vary greatly state to state and generation to generation. they are frequently changing to meet the demands of their retirees and contributors.)

While complex and confusing, you NEED to take that time to sit down and truly understand what your state’s requirements and policies are. For most, this will end up being the biggest chunk of your retirement (AKA your future) so do not just assume everything is going the way that it should be. Even if you are young, make sure you understand what your pension will look like. It might be a driving factor in where you decide to work and small changes while you’re young will amplify in the future!

We work in Minnesota and have an excellent step by step description of how MN TRA works HERE

1. Where does your pension come from?

The common misconception from the private sector is that pensions are gifts from the state as a token of your service… WRONG. You and the district you work for contribute to your pension with every check. Check out your pay stubs. You and your employer both contribute a percentage of each check into the states pension fund. This is typically between 5-10%. For the 2018-19 school year, my contribution was 7.5% of my salary, and my school contributed 7.71% as well. You don’t get a choice in this. This is a number that your state’s government comes up with in order to make sure the fund is healthy, growing, and sustainable. This percentage also changes slightly through the years in order to, once again, make sure the fund is healthy and growing. In Minnesota for example, the school contribution is scheduled to continue to rise to 8.50% by 2023. My rate will rise to 7.75% that same year. This is to help cover the shortcomings of the fund. This will continue to change as numbers come in from future years in the stock market.

2. When do I get my pension?

When you get access to your pension once again varies state by state and generation by generation. The date is typically derived by some type of a formula using your AGE and your NUMBER OF YEARS OF SERVICE. So, for example, in the state of Iowa you can start collecting your full pension once you have hit the RULE OF 88. Meaning once, years teaching + age = 88 then you are eligible for your full pension. For example, if you started teaching at age 22, and taught every year. Then you would be eligible for your full pension on your 55th birthday. That is a great retirement system if that is currently offered in your state. Many are not so lucky. As the rising cost of baby-boomers is increasing they need more of us working paying into the pension. Many states have adopted older retirement ages and gotten rid of age + service rules. In the state of Minnesota there is no longer a rule of 88 or a rule of 90. Retirement is now more directly linked to a person’s age (62-66 years) than service. Thus, for us young teachers, the age for receiving your full pension keeps getting pushed back. I would like to not be working into my 60’s in life that is why I am working hard towards financial independence so I can be in control of my own retirement date. It sounds like a simple idea but pension systems do not like that concept.

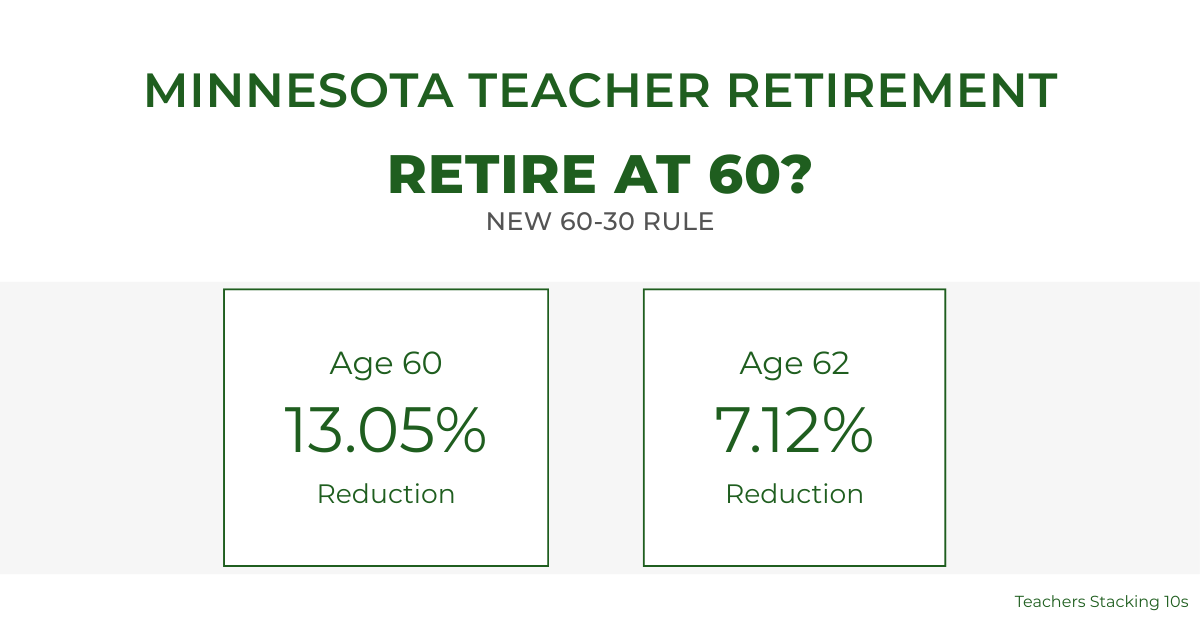

Pension plans do not offer ANY wiggle room as far as age and requirements are concerned. You want to retire early? That’s fine but you will only receive a FRACTION of your potential retirement. So what are all the options and percentages…?

3. How much money will I get from my pension?

Guess what… It varies! But here are the basics. A pension is not a one-time lump-sum amount of money that you get on your last day of work. It is a monthly check that you will be getting from the government until the day you die. Is that check going to be enough to live off of?? Probably not by itself. Let’s talk about what that typically is. Before diving in, one important concept for pensions is the idea of your high 5. When calculating how much to pay out many states will look at an average of sorts of your highest paid years of employment. For the sake of our math let’s say they take the average of your highest paying 5 years of teaching. For our math let’s say that average works out to $65,000

Full Pension – If you meet all of the requirements set by your state to receive your full pension then you can expect a monthly check from the government for roughly 55 – 65% of your high 5 depending on your state’s formula.

Let’s look at an example from our state of Minnesota.

Let’s say I made that $65,000 from my High-5. I started at age 24 and taught until full retirement age of 66. That’s 42 years of service. Minnesota’s multiplier is 1.7% for each year of service.

So the math says 42 X 1.7% = 71.4% of my High-5 salary. 71.4% of 65,000 = $46,410. That’s what I would make every year. This number could vary slightly depending on what kind of survivor benefits you would choose, but my Minnesota teaching retirement would pay me $3,867.50/month for the rest of my life. Not a bad benefit, but be sure to check out #4 before jumping up and down….

Partial Pensions – Let’s say you DON’T meet all of the retirement conditions. DANGER! Retiring early from teaching dramatically reduces your pension. This is why you don’t seem to hear about too many teachers in the FIRE movement. Even something as simple as trying to access your money a month early could reduce your monthly income by 50%… Forever. So that $3,000 a month just turned into $1,500 a month because you have an October birthday and you wanted to start drawing your pension in September. Here are some general rules.

- At any point you can retire and withdraw YOUR half of the pension contribution, but NOT the state’s contribution. This will be viewed as new income so you will have to pay taxes on it. That’s an immediate 50% loss of your money so it’s a big NO!

- You can retire early AND withdraw early but expect a significantly reduced monthly pay out.

- There is potential with many current systems to quit teaching early and elect not to withdraw from your pension until you have reached the correct age. This can result in earning your full pension but it may require you to spend several years not getting paid from working and not earning your pension.

It is an interesting dilemma if you’d like to retire early as a teacher. For example, if you decide teaching isn’t for you and retire after teaching for 6 years. In my state, I’d have 2 options. Option A – take my half of my pension (roughly $25K) pay taxes on it then that money is mine free and clear. Option B – Wait on the pension until age of 55. Then I can collect $250 a month. That is $3,000 a year until I die. Say I live to 75, that pension will have earned me… $60K… Not bad. Worth a lot more than taking your initial cut.

4. The Golden Handcuffs

As you can see, the teacher pension is a great safety net for you when you near retirement age. Some people outside of education will say that it’s a “gold-plated” retirement package, but we view it is a set of golden handcuffs. You are tied to teaching and don’t have the luxury of taking that pension money with you if you decide to change careers like someone in the private sector would. Sure, you are guaranteed an income when you retire, but with more and more people leaving the teaching profession after 5 or 10 or 15 years of work, it is definitely something that will weigh on you if you decide that 20 years of teaching is enough. Grumpus Maximus has a fantastic in-depth series all about pensions and financial independence that is definitely worth checking out.

Closing Thoughts

Remember this is intended as an initial introduction as to what a pension is. If you are in the position where you are considering retiring or walking away from teaching, you should consult an adviser through your states pension department, they will know what options you qualify for.

This all sounds like a lot right now. You are thinking that you are years from retirement and that’s okay. But it’s important to have an idea of how your pension works. It’s an important part of your financial freedom and it’s important to have an understanding of how it all fits into the puzzle. So take some time this week to do the following

Minnesota TRA Full Retirement Age: What Age 65 Really Means

Minnesota TRA Early Retirement Reduction Explained

Minnesota TRA Tier I vs Tier II Explained

Minnesota Rule of 90: Complete Guide for TRA Tier I Teachers

How the Minnesota TRA Pension Is Calculated (Formula, High-5, and Real Examples)

Minnesota Teacher Retirement at 60: Understanding the Enhanced 60/30 Rule

- Log into your state retirement account

- Check your current contribution balance

- Look at your pay stub and figure out what percentage you and your school are contributing

- Start a conversation about roughly when you’d like to retire

Keep Stacking!

Leave a Reply

You must be logged in to post a comment.