YES! You have finally decided to open up your own Roth IRA account. This is a big step to your securing your financial future. I know that it might seem daunting at first, but it’s really not that difficult to do. This guide will walk you through setting up your Roth IRA at Vanguard. I know. I know.. Vanguard again.. The T.A. and I both recommend them as a solid company, but it’s not the only option out there. There are other reputable investing companies, but the T.A. and I both highly recommend Vanguard for their low-cost options.

Setting up your Roth at Vanguard will take you only about 20 minutes. Before you begin, make sure to have your bank routing and account number ready. It will make the process go much more smoothly.

Step 1: Open a web browser and go to https://investor.vanguard.com/home/. You can do this on a mobile device, but it will be easier on a computer. This is their landing page for personal investors. Looking in the upper-right-hand corner, you will see a link that says open an account. I have circled those words in red on the diagram on the right.

Step 2: After clicking on open an account. Vanguard will ask you what you would like to do. Are you setting up a new account, or are you moving money from a different account into Vanguard. For this example, You will be setting up a new account since you are just getting into this investing business!

Step 3: So now you have to decide how to fund your account. There are three different methods you can use.

- Electronic Fund Transfer or move from another Vanguard account.

- Rollover from your employer plan.

- Transfer investments from another financial firm.

You will be doing an electronic fund transfer since it’s our first account you are opening.

Step 4: Now Vanguard wants to know if you are a registered on Vanguard. Obviously if you are following this guide, you are not registered, so click no. You will get to register as you go through this application. Now comes the good stuff.

Step 5: This isn’t really a step, but this screen will show you what you will be deciding on the next few pages. Obviously you are opening a Roth IRA. You will need your bank routing number and account number to complete the application. This is how Vanguard will transfer money in to your account. Don’t worry. It’s perfectly safe!

Step 6: This is the part where Vanguard starts to ask more specific questions about exactly what you are trying to create. Don’t worry. These answers may change later as you get more experienced as an investor. This is a guide. This first page asks if you are setting up an account for retirement, general savings, or education. In this case, you are looking for retirement, so select retirement and wait a few seconds. Another choice will pop up. It now asks if you want a Roth IRA or a Traditional IRA. You want to select Roth IRA and click continue.

Step 7: This step is one that confuses some people. Vanguard asks you what your objectives as an investor are. You will have to select a primary and secondary objective. The choices are capital preservation(NO!), income (OK), growth (YES!), speculation (MAYBE). You can really choose whatever you want here, but I am going to select growth as my primary objective and speculation as my secondary. You could go with income as your secondary as well. Remember, this is not a “final answer”. The other part of this page is that you have to choose the source of funds for this account. There are many options, but most likely, you will choose salary/social security benefits.

Step 8: This step starts the personal questions that Vanguard needs to ask. You will fill in your personal information. Yes, you do need to include your social security number since retirement accounts are considered part of the “tax code”. Don’t worry, as a Roth IRA, you won’t owe any taxes and your social security number is safe. Just keep pushing forward!

Step 9: You will need money to fund this account. This step sets up where those funds will come from. The easiest way is to have the money electronically transferred from another account. You will need the routing number and account number from your bank. Once this is established, you will be able to transfer money in on a regular basis, or whenever you have some extra money lying around!

They will also ask you what you want to do with the dividends from your investments. The best idea is to have the dividends reinvested. This will allow your money to keep working for you with no effort on your part.

Step 10: Now you get to review your information to be sure that it is accurate. You will then electronically sign that you are agreeing to open this account. We are getting close!

Step 11: Finally you will sign up for web access. This is an important step because you will need to use that access to purchase the funds that will be in this account.

Step 12: Now you will need to wait for confirmation e-mails that your account is created. Vanguard will also make a couple of small deposits into your bank account. Once they do, you will need to log in to enter those amounts to verify your account information. Now you can transfer in whatever money you want! (Up to $6k/year)

Step 13: You are NOT done yet. You now have money invested into your Roth IRA. If you do nothing from this point on, that money that you put into the account will be swept info a money market fund that will bring in about 2% in interest. Not bad, but you need to invest that money into something so that it grows even more.

If you are a more visual learner, this Youtube video will also walk you through creating a Roth IRA at Vanguard.

https://www.youtube.com/watch?v=WXpBkW6luUs

In our next post, we will show you how to purchase funds inside this new account.

Keep stackin!

Minnesota TRA Full Retirement Age: What Age 65 Really Means

Most Minnesota teachers hear terms like Rule of 90 or 60/30 long

Minnesota TRA Early Retirement Reduction Explained

Teaching in Minnesota has become more demanding in recent years. Expectations are

Minnesota TRA Tier I vs Tier II Explained

Minnesota Rule of 90: Complete Guide for TRA Tier I Teachers

Minnesota’s Rule of 90 is one of the most consequential retirement provisions

How the Minnesota TRA Pension Is Calculated (Formula, High-5, and Real Examples)

Most Minnesota teachers know they will receive a TRA pension through the

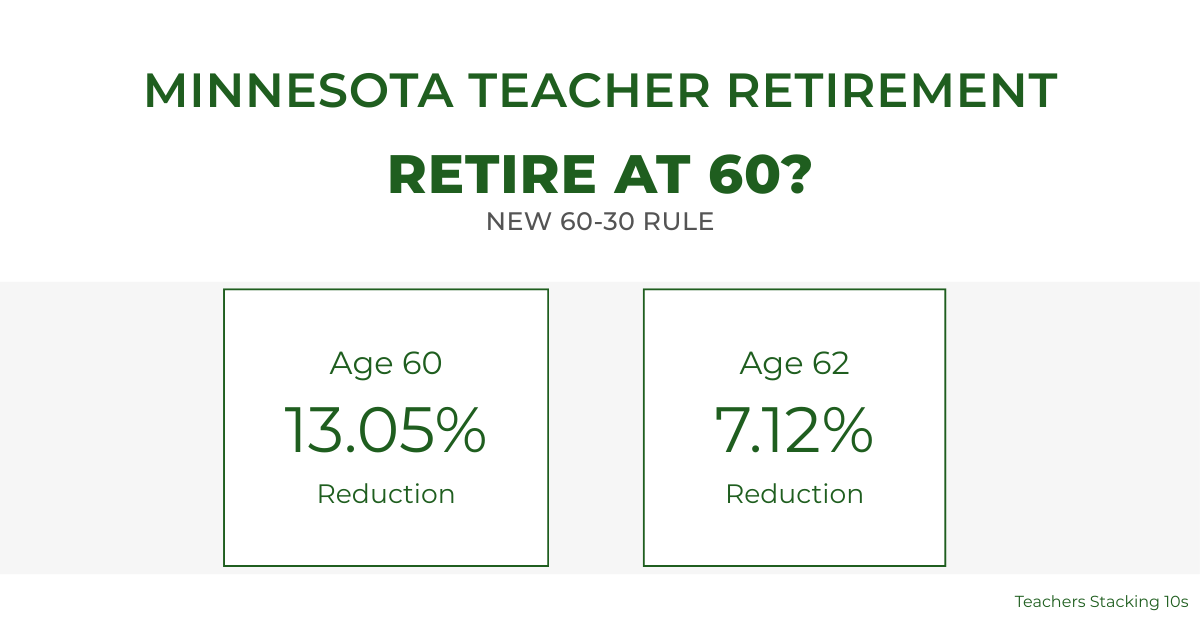

Minnesota Teacher Retirement at 60: Understanding the Enhanced 60/30 Rule

For years, Minnesota teacher retirement at age 60 was financially unrealistic for

Leave a Reply

You must be logged in to post a comment.