So how can someone who is an average wage earner grow their money like a rich person? The answer lies in… math!

We’ve all heard stories about how some little, old lady with no family and worked as a librarian all her life passes away and leaves behind a $2,000,000 estate! People far and wide wonder how could this woman who earned at most $35k in a year could accumulate that much money! The reason is the power of compound interest!

Compounding Interest

Interest is the money you earn from financial institutions for allowing them to use your money to loan out to their clients. Banks can pay you this interest because they charge higher interest rates to their clients. So what is “compounding interest”? Compounding interest is how your money grows each year. Look at the following example.

Let’s say you deposit $10,000 into a savings account that will pay you 2% interest each year. This is a very realistic rate that you would earn from a savings account from an online banking institution. What’s not realistic is we are not going to be adding anymore deposits to this account during the year. At the end of the first year, the bank adds your 2% in interest to your account. Again, they will usually do this monthly or quarterly, but we are going to keep it simply with yearly interest. So they add $200 to your account. Now you have $10,200 in your account. At the end of the second year, they add another 2% in interest, not just on the $10,000, but on the $10,200 that you now have. So at the end of the 2nd year, they add $204 to your account. Now you have $10,404 in your account. End of the 3rd year, they add another $208.08 giving you $10,612.08. That is compounding interest. This might not seem like great growth, but that’s the process. The better return you can get from your money, the faster it will grow.

The Rule of 72

We’ve looked at compounding interest. There is a simple way of calculating what your money will do over time. You look at your rate of return and see how many times it will go into 72. The total will be how many years it will take you to double your money. So in our previous example of 2% interest, we would double our money every 26 years. Not a great rate of return. Let’s say we take that same $10,000 and invest in the stock market that will return on average 7%. We should double our money in 10 years. Everything rounded to the nearest whole dollar.

Starting money – $10,000

Rate of Return 7%

Year 1 – $10,700

Year 2 – $11,449

Year 3 – $12,250

Year 4 – $13,108

Year 5 – $14,026

Year 6 – $15,007

Year 7 – $16,058

Year 8 – $17,182

Year 9 – $18,385

Year 10 – $19,671

So you can see that after 10 years, even with you doing absolutely NOTHING, you have doubled your money! This is without you adding ANY more money into your account! This is the power of compounding interest!

Now let’s look at an that same scenario except that we will continue to add $100/month to that account since we should constantly keep saving.

Starting Money – $10,000 adding $100/month

Rate of Return 7%

Year 1 – $11,900

Year 2 -$13,933

Year 3 – $16,108

Year 4 – $18,436

Year 5 – $20,926

Year 6 – $23,591

Year 7 – $26,443

Year 8 – $29,494

Year 9 – $32,758

Year 10 – $36,251

So just by adding another $100/month into our account, we have increased our total savings by another $16,500. This is something that you can achieve! Now let’s imagine you have followed the T.A.’s advice and have become a super saver $500/month. What would those numbers look like?

Starting Money – $10,000 adding $500/month

Rate of Return 7%

Year 1 – $16,700

Year 2 – $23,869

Year 3 – $31,540

Year 4 – $39,748

Year 5 – $48,530

Year 6 – $57,927

Year 7 – $67,982

Year 8 – $78,741

Year 9 – $90,253

Year 10 – $102,570

This is where you can really start to see why we need to work on that savings rate and how we can start to build true wealth. So as you continue to build your portfolio, you can start to project the money you will have as you go through the years.

Keep stackin!

Minnesota TRA Full Retirement Age: What Age 65 Really Means

Minnesota TRA full retirement age is 65. Learn what normal retirement age means, when benefits are unreduced, and how early retirement reductions apply.

Minnesota TRA Early Retirement Reduction Explained

Learn how Minnesota TRA early retirement reductions work, how age-based factors reduce your pension, and when the Rule of 90 prevents a reduction.

Minnesota TRA Tier I vs Tier II Explained

Minnesota TRA Tier I vs Tier II is based on your hire date and determines whether you qualify for the Rule of 90, what your full retirement age is, and how early retirement reductions apply. Understanding your tier is the first step in building an accurate Minnesota teacher retirement plan.

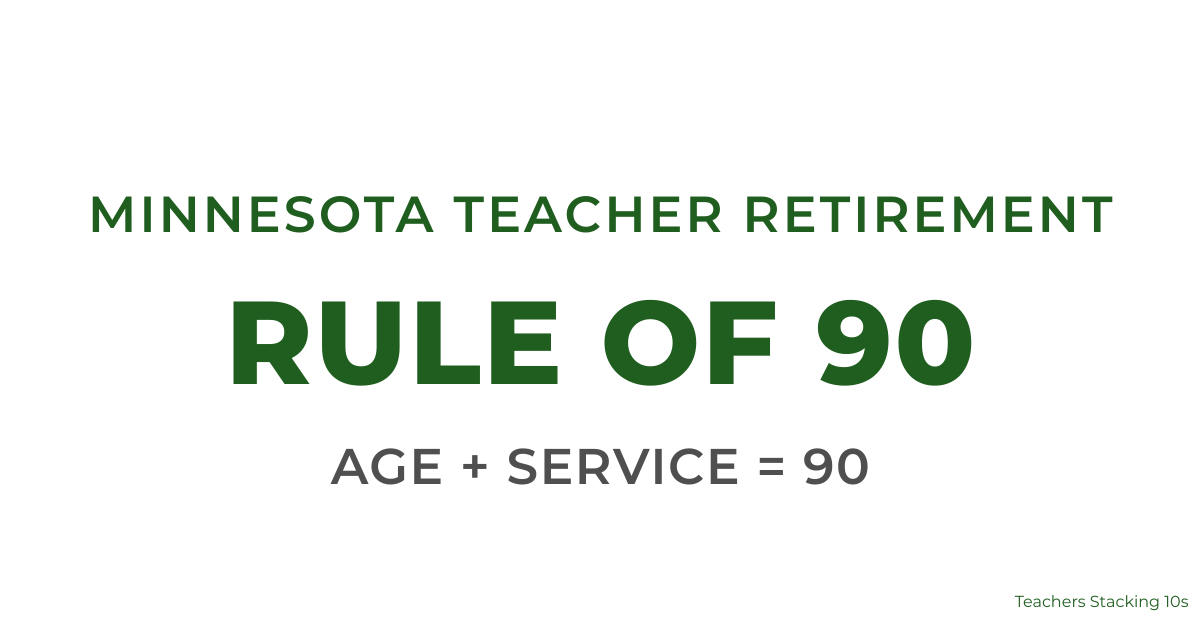

Minnesota Rule of 90: Complete Guide for TRA Tier I Teachers

Minnesota’s Rule of 90 allows certain Tier I teachers to retire when age plus service equals 90 without early reduction penalties. Here’s who qualifies and how it compares to 60/30.

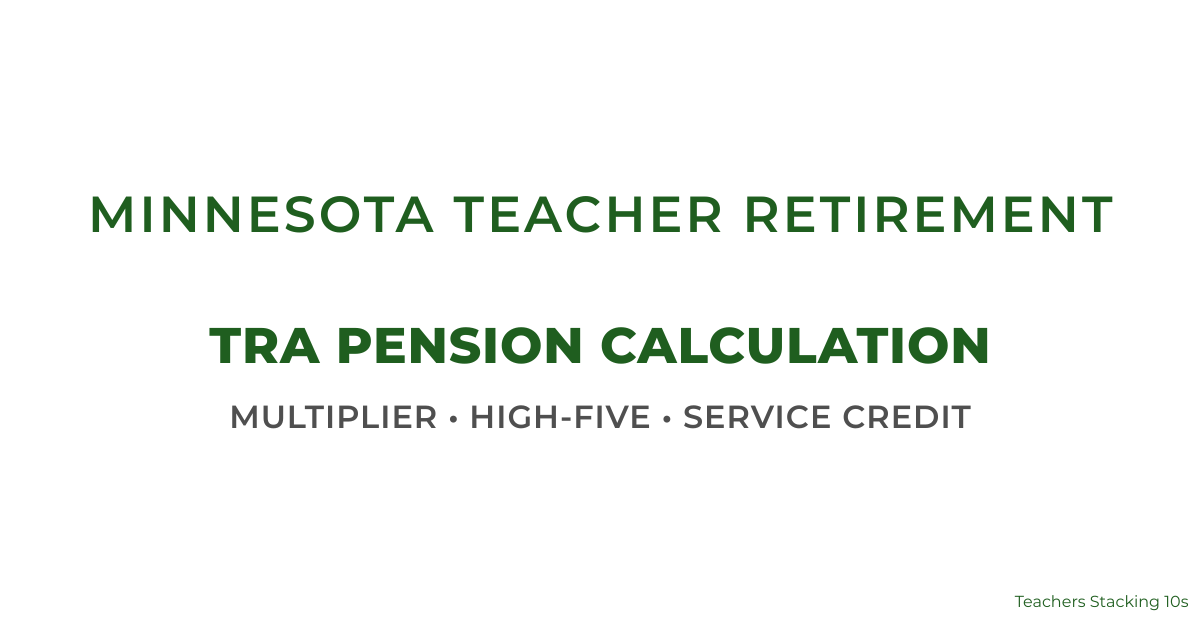

How the Minnesota TRA Pension Is Calculated (Formula, High-5, and Real Examples)

A clear breakdown of how the Minnesota TRA pension is calculated. Learn how multipliers, High-5 salary, and service credit determine your benefit, with real examples and early retirement comparisons.

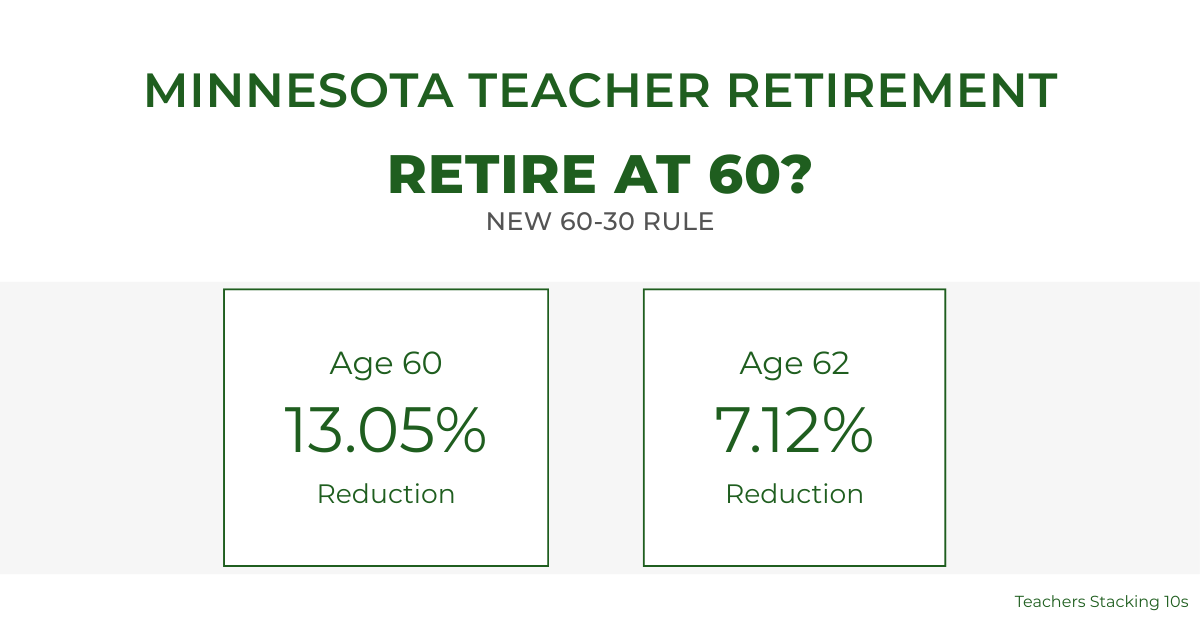

Minnesota Teacher Retirement at 60: Understanding the Enhanced 60/30 Rule

Minnesota’s new 60-30 pension rule is a historic win for educators—allowing earlier retirement with fewer penalties. It brings long-overdue fairness to Tier 2 teachers, boosts retention, and signals progress. But the fight isn’t over—educators must still push for an unreduced 60/30 career rule to achieve full equity and security.

Leave a Reply

You must be logged in to post a comment.