“Be careful on what size of house you buy because you’ll end up buying enough crap to fill it” – Papa T.A.

In the fall of 2015 I purchased my first house. I had been bouncing around to different apartments and rental houses for the previous 7 years, all the while paying someone else to live in their place while they generated some nice passive income from me. Finally, I decided enough was enough and purchased my first home. A small, 2 – bedroom house that was over 100 years old and in need of several cans of fresh paint. As I was looking at houses I remember my father, a life-long frugal man, comment, “Be careful on what size of house you buy, because you’ll end up buying enough crap to fill it.” Being in my 20’s and used to the annual purge that comes from switching apartments I thought there was no way I would ever fill an entire garage, 2 bedrooms, a basement and all of the storage that came with it. Fast forward to 2019 and low and behold I have managed to fill my small 2 bedroom house with crap.

While many human beings do this same thing with their own homes I think it is far more dramatic with our Paychecks. Think back to a time when you first started working. Go look at those old paystubs and see what you were able to live off of when you first took that teaching job. How many started below $40k annually? How many below $30k? Yikes. Yet we, for the most part, were able to pay bills, enjoy life, take vacations etc. on that smaller amount of money. in 2019, I make considerably more than I did in 2012, On average $500 a check more, Yet I still find myself feeling financially stressed at times. How is this possible? Making $1,000 more per month yet still have financial stress? The answer is Lifestyle Inflation.

Lifestyle Inflation is when our monthly expenses slowly creep up to match our added income. Sometimes it shows up as an immediate purchase shortly after or even before an expected raise or bonus comes in. Think, Clark W. Griswold spending his Christmas bonus on a swimming pool before even seeing if he got an bonus or not. Other times it creeps up on you in small extra expenses that consistently add up. For myself, this manifests in craft beers and Amazon purchases. 22-year-old me had no problem walking past the local 6-packs to grab the Buschlight for a fraction of the price, He also would’ve laughed at me for being an amazon prime member because why on Earth would I be buying that many things online, there wasn’t any more room in the apartment! Small expenses like this continue to add up until you hit that stress point again and you’re right back to where you started financially; stressed, not saving anything, and assuring yourself that if you just made more money that would be the answer. Well, I have news for you, if you don’t confront the lifestyle creep no amount of income will ever be enough. Case in point – Had a conversation with a friend of mine who is in the private sector. Making well over what a teacher would make. He is fixed on the idea that once he gets his next bonus then he’ll really be able to start paying down his student loans and truly investing. He says that as he makes $80k a year. However, his rent is triple what my mortgage is, he likes his new cars and nice watches etc. So simply getting more money for most of us won’t save us from that financial stress. You need to FIGHT THE LIFESTYLE CREEP!

So how can we fight this? Auto investing is a great first step. Schedule a transfer to your savings account or your investment account shortly after your payday. For me, it’s the next day. So many time I don’t even see the full amount of that paycheck in my account before a couple of hundred dollars are pulled out and put into an account that I won’t spend down. Another great way is to up your increase to your 403b. This is a pre-tax contribution so there are some additional benefits for choosing this route. It is harder to access this money in a pinch so I tend to only increase my 403 contributions slightly each year. Similarly, you can increase your contributions to your HSA account. Basically, save first, not last. If you choose to look at your account at the end of each month and save whatever is left it’ll always be less than if you were to set an amount to get taken out of to start with. In addition to saving first, you should just be aware of that inflation creeping into your life. As you are online shopping or getting your groceries for the week don’t forget about your frugality just because you got paid yesterday. Evaluate your financial decisions based on the happiness those purchases will provide you. Don’t buy a $250k house just because that’s what your friend did, think about what will make you happy. A big house with a big mortgage payment with all kinds of rooms to start accumulating your own collection of crap. Or a smaller house with a smaller mortgage payment and some money to invest or to travel or to do whatever it is that brings you joy.

So take some time and look back at those early checks to see what you used to be able to live off of. Figure out how much you want to start auto-saving even if it’s $50 just start. Lastly, look at what you are buying and how much joy that purchase is bringing you and decide for yourself if it is worth it or not.

Keep Stackin!

Minnesota TRA Full Retirement Age: What Age 65 Really Means

Most Minnesota teachers hear terms like Rule of 90 or 60/30 long

Minnesota TRA Early Retirement Reduction Explained

Teaching in Minnesota has become more demanding in recent years. Expectations are

Minnesota TRA Tier I vs Tier II Explained

Minnesota Rule of 90: Complete Guide for TRA Tier I Teachers

Minnesota’s Rule of 90 is one of the most consequential retirement provisions

How the Minnesota TRA Pension Is Calculated (Formula, High-5, and Real Examples)

Most Minnesota teachers know they will receive a TRA pension through the

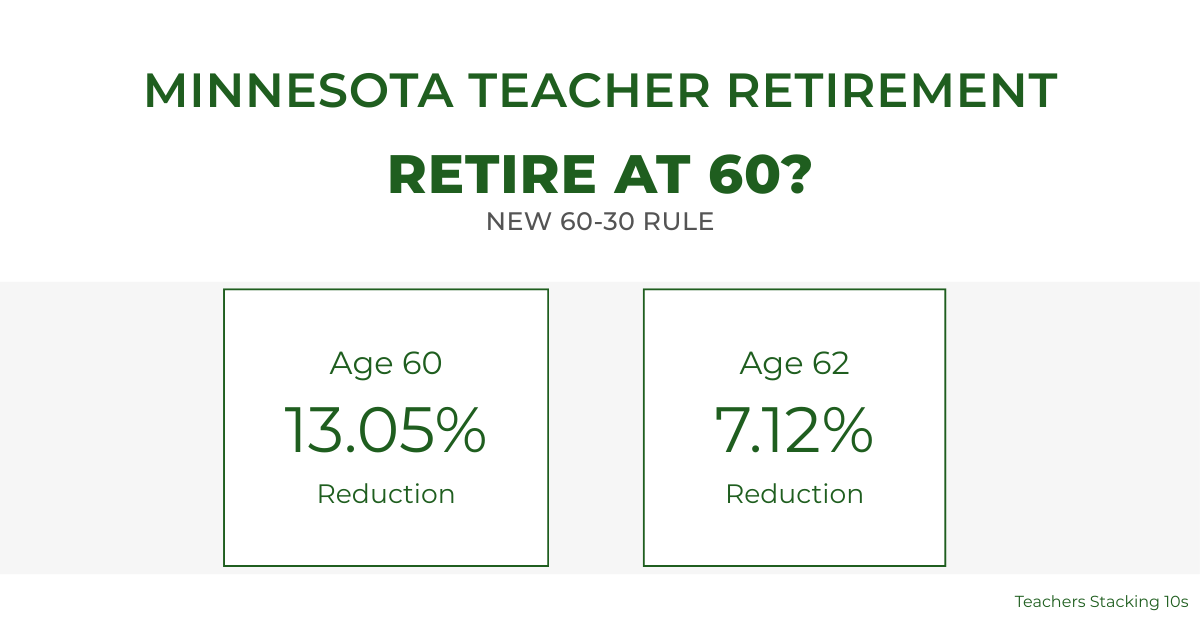

Minnesota Teacher Retirement at 60: Understanding the Enhanced 60/30 Rule

For years, Minnesota teacher retirement at age 60 was financially unrealistic for

Leave a Reply

You must be logged in to post a comment.