Everything you need to know about what might be one of the best investment tool to add to your portfolio.

First things first, if you are single and under the age of 26, you should be staying on your parents’ health insurance plan. Typically this makes the most financial sense. Sometime right before that 26th birthday you’ll be looking for what kind of health insurance you should be getting. I would suggest getting a high deductible plan with an HSA.

What is an HSA? An HSA is a Health Savings Account. They were created in 2003 in order to help out people that had a high deductible health insurance plan. For young people, it makes a lot of sense. Typically, young people don’t need the more expensive plans with better coverage but much higher premiums. In my 8 years of employment, I have only recently gone to the doctor for a cholesterol check. Other than that I haven’t had the need to schedule a doctors appointment. Therefore, it wouldn’t make a ton of sense for me to pay large sums of money each month for a high end health insurance plan when I don’t need one. Enter the high deductible plan. First up, a deductible is the amount of money you have to pay out of pocket before your insurance kicks in. For us single young people that are healthy, our best bet might be going with a high deductible plan with that HSA account.

HSA accounts are Triple Tax Advantaged – meaning…

1. It is put into an account pre-taxed – When you contribute to your HSA it comes out of your check before taxes are taken out. We haven’t discussed a lot about taxes here on Teachers Stacking 10’s but whenever we can lower our taxable income that is a big win! There is a limit to your contributions however – $3,550 for single and $7,100 for family plans.

2. The gains on that account are not taxed – Your HSA can be invested. I have recently switched my HSA from my local bank into a Fidelity HSA account. This means I can have take those couple thousand dollars and leave it sitting in index funds to grow. On top of that I will not be taxed on those gains! Unheard of.

3. The money is not taxed when you spend it. You can spend your HSA on anything related to medical expenses… This is the current list as to what qualifies for a medical expense – http://www.hsabank.com/hsabank/learning-center/irs-qualified-medical-expenses. So long as you are spending that money on medical expenses you never have to pay taxes on it!

So rather than spend a lot of money each month for a health insurance plan with a big premium I have gone with the high deductible plan. My current deductible is roughly $5,000. I know that seems like a lot. But since I am a healthy person without any kids I don’t have medical expense. Instead I have chosen to bank up my HSA for the emergency where I might need to use that big time deductible. The main benefit of that is more money is at my disposal while still being covered in the event of a catastrophe.

Health care is pricey. But using an HSA we can help offset some of these costs

If you decide that an HSA is right for you, where should you open an account?

The decision as to where to open your HSA does carry some significance. During the initial stages of my HSA, I simply opened up an account with my local bank. It has been a smooth process. No problems with the deposits or setting up an account, and they provided a separate debit card for me to use on qualifying purchases, which have been low. So for the most part the money just sits there, gaining .15% interest. Yes that is a fraction of a percent interest which translates to a couple of bucks a year… OUCH! Recently, the account has grown and I have decided that the minor conveniences are not worth the dollars that I throw away each year in interest. With about $2,000 in my account the difference is roughly $3 a year interest compared to $140 if that were invested in Index funds. That is reaching the point of interest earning me a free check-up at the dentist every year. I CAN’T MISS OUT ON THAT!

So enter FIDELITY. After a lot of research in various sources time and time again I came across Fidelity as the most recommended vendor for HSA accounts. A couple of things have stood out to me about them.

1. They do not have a minimum cash holding balance before you can invest. What this means is that some vendors require that you have an amount ($2000 cash) that must stay in your account and is not invested. Thus you invest on every dollar past that minimal required amount. Not great for me. Yes, I have some money in my account but I’m in no rush to start socking money away into it. Fidelity doesn’t do this. The first dollars you deposit with them can be invested. This pleases me.

2. A wide variety of low-cost index funds to choose from. While it is true that Vanguard is the god father of the index fund, Fidelity also has some very good options with a very small expense ratio, some below .03%! This is big to all for my investment options to keep those expense ratios down. On paper those percentages can look small and be easy to miss, but over the lifetime of your accounts can add up to thousands of dollars!

ONE DRAWBACK

The Fidelity account won’t have a debit card. To keep an HSA in an investment account, you lose the ability to immediately pay your bills with that HSA while you are still in the office. Instead you pay using your credit card or checking account, then later if you would like to reimburse yourself for that expense you can deposit that money from your HSA into your checking. It’s important here to keep a copy of the receipt. I usually just save a digital copy to show proof of the expenses you are covering with that money. Remember, an HSA is tax free so the IRS likes to keep it that way. So long as you have the receipt of purchase you’ll be just fine.

So the Fidelity HSA experiment has begun. I’ll be keeping an eye on how my investments grow and seeing how convenient the account is to access when I need it. Overall I’m excited to put more money to work for me gaining that compound interest! Check out the expected growth of $2,000 over 20 years below. $7,739 vs. $2,061!

So it’s important for you to start looking at the numbers for yourself. If you have a lot of reasons to go to the doctors frequently (aka kids) maybe the high deductible plan isn’t the right fit for you but for the rest of us it is definitely worth considering. I have roughly $2K sitting in my HSA which is invested in index funds which are currently earning 7% per year, think about how that can grow! To me in my situation that makes much more sense.

KEEP STACKIN!

Minnesota TRA Full Retirement Age: What Age 65 Really Means

Most Minnesota teachers hear terms like Rule of 90 or 60/30 long

Minnesota TRA Early Retirement Reduction Explained

Teaching in Minnesota has become more demanding in recent years. Expectations are

Minnesota TRA Tier I vs Tier II Explained

Minnesota Rule of 90: Complete Guide for TRA Tier I Teachers

Minnesota’s Rule of 90 is one of the most consequential retirement provisions

How the Minnesota TRA Pension Is Calculated (Formula, High-5, and Real Examples)

Most Minnesota teachers know they will receive a TRA pension through the

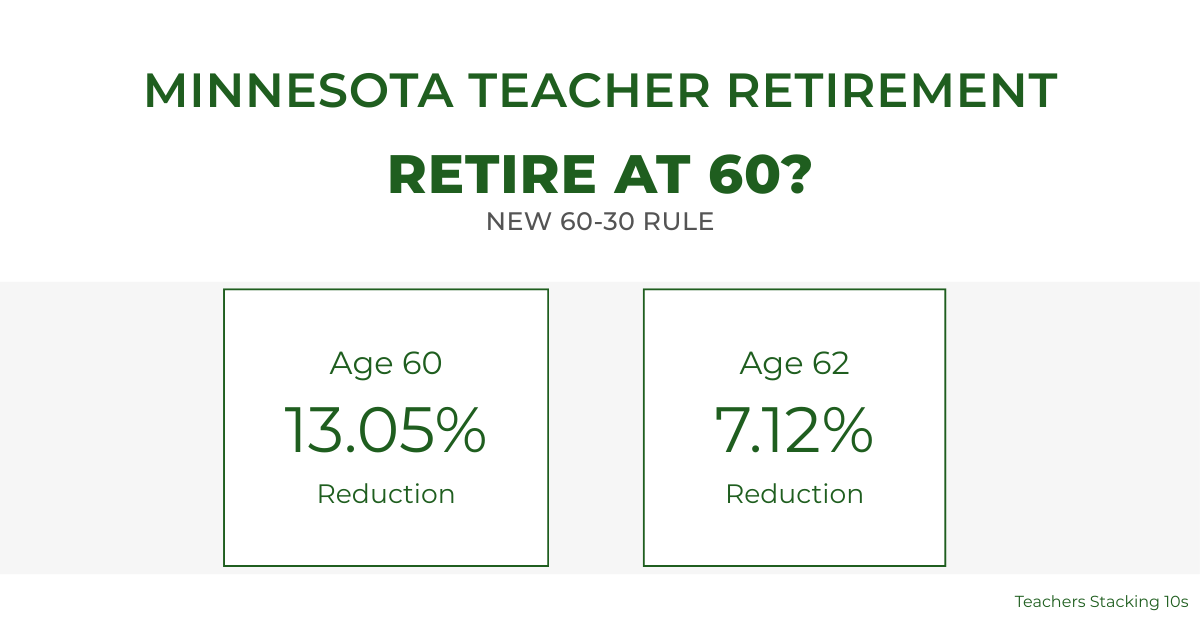

Minnesota Teacher Retirement at 60: Understanding the Enhanced 60/30 Rule

For years, Minnesota teacher retirement at age 60 was financially unrealistic for

Leave a Reply

You must be logged in to post a comment.