Here we have another great book on understanding you and your money. This one focuses more on the “how” of earning money and is very important for us as teachers. Rich Dad’s Cashflow Quadrant by Robert T. Kiyosaki looks at money from a different lens. We might be teachers that are currently dependent on earning our money from a school district, but we can, and should, look at moving from that “E” quadrant as much as possible! I will include a chapter summary in regular print and then my thoughts and review in italics.

This book is a must read for the teacher that doesn’t want to be trapped by the “Golden Handcuffs“ of our pension.

PART 1 – The Cashflow Quadrant

Chapter 1 – Why Don’t You Get a Job?

The book doesn’t start out as you might expect. Mr. Kiyosaki starts his story in 1985 when he and his wife were homeless. They did the occasional odd job to keep themselves fed and gas in the car in which they lived. People asked them why they didn’t get jobs. Both were college graduates who qualified for a variety of good-paying positions, but they had a different goal. They were not after job security, but financial freedom. They wanted to develop a successful business that would bring them money even if they stepped away. They didn’t want to be Es. This is where he introduces the Cashflow Quadrant.

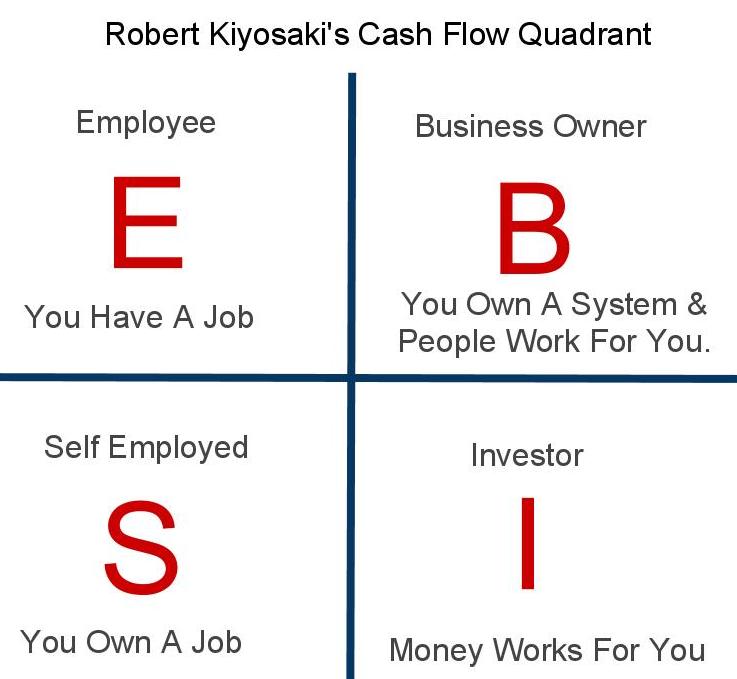

The image above shows these four quadrants. He doesn’t go into detail yet, but if you bring in money, it comes from one of those four quadrants, BUT it doesn’t mean that you can’t bring in money from other quadrants as well. He says you can be rich or poor in ANY of the four quadrants. It really depends on your personal strengths and weaknesses. Mr. Kiyosaki refers back to his first and most popular book, Rich Dad, Poor Dad throughout this book. He recalled how his “poor dad” would tell him that money wasn’t important to his life, yet he spent much of his life working for it. Whereas his “rich dad” felt that money was important to him “living life” and found ways to earn money without giving up his time working for it. Mr. Kiyosaki points out that his “poor dad”, who earned his money on the left side, had to spend more time working as he made more money, but his “rich dad”, who earned his money on the right side, worked less as he made more. Mr. Kiyosaki ends the chapter stressing the point that no quadrant is better than another. Each has its strengths and weaknesses.

This first chapter doesn’t really get into the finer points of the four quadrants, but something that stuck out to me immediately when I read through it the first time was that I had always just taken for granted that ALL people work a job. Everyone gives up their time for money, and the more money you make, the more time you give up. As I’m sure many of you were told growing up, “Go to college and get a good job.” Heck, isn’t that the whole core of what we say as educators?? “Make sure you go to college so you can get a good job.” This statement is true for some people according to Mr. Kiyosaki, but not all….

Chapter 2 – Different Quadrants, Different People

This chapter introduces the idea of how people can move from one quadrant to another. Mr. Kiyosaki says that he learned from his “rich dad” that anybody can move from one quadrant to another, but it’s not as easy as just deciding to move. The quadrant you are in is really at the core of who you are. You might have the intellectual knowledge to move from one quadrant to another, but you may not have the emotional ability to handle the ups and downs typical of a different quadrant. He also can tell a person’s quadrant by the words that they use.

The E (Employee)

E-Quadrant Words – Safe, secure job, good benefits

People from the E quadrant hate the fear that comes with “economic uncertainty”. They want a steady, secure job with good benefits. For people in this quadrant, security is more important than money. Employees can be the president of a company or the janitor. It’s not really what they do, but the contractual agreement they have with who hires them.

The S (Self-employed OR small-business owner)

S-Quadrant Words – My rate is $75/hour. My commission is 6%.

People from the S quadrant are ones who want to be their own boss. They don’t like to have their income dependent on other people. People in the S quadrant are usually very independent. Whereas an E responds to fear of not having money by looking for security, an S will look to take control of the situation and do it on their own. This profession often includes educated professionals such as doctors, lawyers, and dentists. It also includes small business owners, direct-commission salespeople, and real estate agents. Many S people are perfectionists and often feel for a job to be done right that they have to do it.

The B (Business owner)

B-Quadrant Words – I’m looking for a manager to run the day-to-day operations.

People from the B quadrant are really the opposite of the S. These people like to surround themselves with people from the other categories to become more efficient. They like to delegate work to others who are more knowledgeable in that area. Bs are usually strong leaders that can inspire others, but the biggest difference between the small-business owner (S) and business owner (B) is that the B can leave their business for a year and return and the business is more profitable and running better than they left it. If an S leaves their business, it usually disappears. So the S owns a job, the B owns a system.

The I (Investor)

I-Quadrant Words – Is my cash flow based on an internal or net rate of return?

The I quadrant is where the wealthy exist. No matter which quadrant you are in now, if you want to become rich, you MUST eventually move into the I quadrant. This is where money turns into wealth. In this quadrant, your money actually works instead of you! I quadrant people invest in many things. Stocks, businesses, real estate, start-ups, etc.. Mr. Kiyosaki states that most Es do spend time in the I quadrant through their retirement accounts, but he believes this is more like saving than investing. He states that I’s make their income through the investments and not from a job. One of the biggest benefits of this quadrant is that money earned in the I quadrant is taxed differently, and usually more favorably, than money earned in the other quadrants, the E and S quadrants especially!

Mr. Kiyosaki ends the chapter by really going after pension plans. He believes that pension plans are a relic of the Industrial Age where you worked for one company your whole career. We are in the new Information Age, and people need to plan for retirement differently. People should be very careful with their 401(k) plans and make sure they take the reins of their own personal finances and not hope that the government will save them when they retire.

This chapter held a TON of information. I hope I did it justice with my explanation. As teachers, we definitely fit right into that E quadrant. Most teachers really count on that security of holding a job for their entire career. But we are fortunate to still possess one of those pension plans that Mr. Kiyosaki kind of beats down at the end of the chapter. I think an important takeaway from that is that teachers should NOT plan on their pension and social security being their only source of income in retirement. You MUST put money into your 403(b) account and truly INVEST that money. This will require you to learn about your 403(b) company and the agent you work with. Do NOT let them just have full “control”. They definitely do not have YOUR best interests in mind. Their interests will ALWAYS come first.

Chapter 3 – Why People Choose Security Over Freedom

Mr. Kiyosaki gives a very simple answer to this question. It’s because that is what people are taught from the time they enter school. They are told to go to college, get a degree, get a good job with benefits. This leads them on a path to the left side of the CASHFLOW quadrant. This is where the job security is, but the financial security exists on the right side. He states, “The main reason that 90 percent of the population is working on the left side is because that’s the side they learned about at school. After leaving school, they often end up with lots of expenses and may fall into debt. This means they must cling ever tighter to a job, or to professional security, just to pay the bills.” He goes into various scenarios people find themselves trapped on the left side of the CASHFLOW quadrant. The success trap on the left side is that getting more money usually means more work which requires more time. On the right side, getting more money involves bringing in more people or deploying more capital, NOT necessarily more of your time. Financial freedom and security are rarely found on the left side. They are only found on the right side. One common pattern is someone moving from E to S. This is the person that the author feels the most sorry for. By moving from the E to the S, they often find themselves working harder and more hours in their pursuit of freedom. Mr. Kiyosaki then goes into detail about how most of the tax advantages that exist in America today live on the right side. It’s all about where a person earns their money. He ends this chapter discussing how people can expand their lives and exist in more than one quadrant at a time. He suggests that the E develop or create a B or spend time in the I quadrant by truly learning about investing and not blindly turning their money over to a financial advisor. In fact, he states that people feel much more secure if they operate in more than one of the quadrants.

This chapter really underscores what we are trying to do here at Teachers Stacking 10s. The TA and I believe that as teachers we can truly become financially free, but not solely through coming to school everyday. We can leverage the money that we make at school and use it to invest in things like stocks and real estate. Heck, this website could even push us into the B quadrant some day. (Not that we make any money on this site.) Some teachers we know also own small businesses. Some sell content that they have created through sites like Teachers Pay Teachers. Some own a rental property that they manage themselves. Moving into the B or I category doesn’t mean we need to become the president of a multi-national corporation, or stand on the New York Stock Exchange. We can all incorporate parts of these other quadrants to enhance our financial freedom and give us a chance to loosen those “Golden Handcuffs” that we all wear, known as our “Pension Date”.

Chapter 4 – The Three Kinds of Business Systems

Mr. Kiyosaki starts by reminding people that being a B means you own a system and people work that system to make money for you. He mentions 3 different types of businesses. They are:

- Traditional C corporations – where you develop your own system

- Franchises – where you buy an existing system

- Network marketing – where you buy into and become part of an existing system.

<p “=”” style=”” tve-droppable”=””>He stresses that an important part of being a business owner is learning from your failures. He states, “Success is a poor teacher.” He give three ways you can make it to the B-quadrant quickly. <p “=”” style=”” tve-droppable”=””>1. Find a mentor. <p “=”” style=”” tve-droppable”=””>This is what Mr. Kiyosaki did in his early life. His “rich dad” taught him the ins and outs of running a business and how to manage people. He says to remember that a mentor is someone who has already done what you want to do. You don’t want an advisor. These are people that tell you what you should do. Most advisors are actually from the S-quadrant. He thinks that if you are working as an E for a large corporation, you can learn from them and it is like being paid by a mentor. Once you have spent time learning the various systems in a big company, you will be ready to leave and start your own company. <p “=”” style=”” tve-droppable”=””>2. Buy a Franchise <p “=”” style=”” tve-droppable”=””>By buying a franchise, you are buying a company’s system and using it as your own. Your focus will be managing people. He does warn against people with an S-quadrant mentality from purchasing a franchise. People from the S-quadrant like to do things their own way and that doesn’t work in a franchise. The author talks about his “poor dad” that failed when he bought a famous ice cream franchise. The system was excellent but it failed because his highly educated father and his partners were all E’s and S’s who didn’t know what to do when things started to run poorly. <p “=”” style=”” tve-droppable”=””>3. Get involved in network marketing <p “=”” =””=”” style=”” tve-droppable”=””>This is another example of buying into a system. The difference is that a franchise could cost hundreds of thousands of dollars. Network marketing is more like a personal franchise. Many times the cost to buy in is just a few hundred dollars. He says an important part of network marketing is getting past your fear of rejection and learning to lead people. He thinks that you should focus on the education that a network marketing company provides over the product that they offer. He said you should do your research on any network marketing company before joining. Too often, people just look at the product and everything starts out great, but without proper mentorship and guidance, it falls apart when sales start to slow down. <p “=”” =””=”” style=”” tve-droppable”=””>He ends with the reminder that a system is the key to building your own business. This system is the bridge that can provide a path from the left to the right side of the Cashflow Quadrant. <p “=”” =””=”” style=”” tve-droppable”=””>This was an interesting chapter for me. I’ve never started my own business and haven’t even really thought of it before. Personally, I am not a fan of the network marketing businesses that Mr. Kiyosaki discusses in-depth in this chapter. I’ve always viewed network marketing as a “gimmick”. We all know someone who has jumped into one of these companies and claimed how they were going to make a bunch of money only to give up after they found out that it actually took some effort.

Chapter 5 – The Five Levels of Investors

Mr. Kiyosaki believes that all people should learn to invest. The I-quadrant is important because this is where your money is working for you. He also believes that most people really don’t have the financial knowledge to invest properly. Many people feel that investing is “risky”, but he feels that not have financial knowledge is where the real “risk” lies. He is not a fan of most 401(k) plans. He says, “The 401(k) is for people who are planning to be poor when they retire.” He feels that most advisors in 401(k) plans are not really investors, but are E-quadrant and S-quadrant employees who make their money off of your hard-earned money. He doesn’t view one type of investing as “better” than another. It all depends on the investor’s knowledge in that area. He believes there are 5 levels of investors.

Level 1: The Zero-Financial-Intelligence Level

This is the category of people who actually spend more than they earn. He claims that over 50% of the country falls into this category. These people spend their money on liabilities instead of assets that will increase in value over time. To determine if you are in this category, ask yourself if you have no assets but a high level of debt.

Level 2: The Savers-Are-Losers Level

These are people who think they are doing the right thing by socking money away into their savings’ accounts or bond markets. The problem with these areas is that they actually losing money as their gains are overtaken by inflation. These people will actually have less purchasing power with the money they accumulate than when they earned it. To determine if you are in this level, do you have a large amount of money in your savings account or a simple 401(k).

Level 3: The I’m-Too-Busy Level

This person is too busy with life to learn about investing. These are people who are highly educated and often highly compensated. This is the level that most people who invest in their 401(k) are at. They “hope” that their advisor knows the correct investments to put their money in. Sometimes they are correct. Other times they are terribly wrong….. To determine if you are in this level, ask yourself if you are still only investing only in your retirement account and paying high fees.

Level 4: The I’m-a-Professional Level

This is the DIY investor who picks a few stocks to buy and sell. If they invest in real estate, they usually do all the work themselves. Many retirees jump into this level since they have more time on their hands. If these people work on their financial education, they can move into the top level. You are at this level if you have increased your knowledge and are picking some stocks to invest in outside of your retirement accounts.

Level 5: The Capitalist Level

This is the level where the richest people in the world reside. The level 5 investor doesn’t just limit themselves to using their own money to invest. They actually use other people’s money (OPM) to grow their wealth. They leverage their real estate transactions. They use bank loans to grow their business. They use a team to invest their money in the best assets. These people are very good at raising capital by working with other people. They are not afraid to use debt as a tool to grow.

He closes the chapter with the statement that the I-quadrant is your ticket to freedom and financial security. It requires some effort on your part to learn about assets and liabilities and where you can use leverage to grow your wealth.

This is a hugely important chapter for me. I spent the first 15 years of my teaching career in level 3. I consistently contributed to my 403(b), but I really didn’t have any idea where my money was going. I can’t imagine the thousands of dollars I have lost over the years to my “advisors”. Finally about 10 years ago, I realized that I wasn’t where I wanted to be when it came to money. It struck me that I was “stuck” in the classroom until I qualify for my pension at 62. Ouch! As I learned more, I realized that I was in the same boat as most Americans. My wife and I had a pretty good chunk of money in our retirement accounts, but we were living paycheck to paycheck. We were “illiquid”. All of our money was invested in accounts that are inaccessible until we are 59.5! As I learned more, I slowly moved into level 4. I will say the TA and I are both continuing to learn in level 4 and trying to work our way into level 5. Of course, there are some hard lessons to learn in level 4. Hmmm. GME. Soon, we are both hoping to move into level 5 and start to leverage debt to grow our wealth!

Chapter 6 – You Cannot See Money With Your Eyes

At first glance, the title of this chapter seems a little weird. Of course you see physical money with your eyes, but what Mr. Kiyosaki is talking about here is the concept of making money. Too many people invest in things because of what their eyes see or their emotions tell them. These people rarely make money. They may not lose either, but they never really grow their wealth. These are the “get rich quick” people that don’t invest, but rather speculate on an investment. According to the author’s rich dad, “The average person is 95 percent eyes and only 5 percent mind when they invest. If you want to become a professional in the B and I quadrants, you need to train your eyes to be only 5 percent and your mind to see the other 95%.” An important part of this is learning the language of each quadrant. If you don’t understand the words, you will never understand if an investment is a deal or not. He says that most people obtain most of their financial knowledge at home and “most people don’t come from financially sound families.” Mr. Kiyosaki branches off in the chapter to talk more specifically about saving money and real estate. He continues into depth on mortgages and how people still cling to the fallacy that your home is an asset. Even if you completely pay off your mortgage, your house still is not an asset. It still costs you money to maintain and you will still continue to pay property taxes on it. Your savings account, on the other hand, truly is an asset. It is earning you money each month in interest. The problem is that to the bank, your money is technically a liability on their financial statement. That’s why you really get no tax breaks for saving money, but you do in real estate! In his mind, it’s all about who owes who. The goal is to become the person that money is owed to instead of owing other people, including the banks! For most people, money is about survival. For the wealthy person, money is a game. A game that is much like Monopoly in that you want to control the assets and be the person to whom others are indebted. This is shown in some of the common words we see on advertisements today. Things like “low-down payment” or “easy monthly payments” are immediate signs that others are trying to put you into debt. It is your responsibility to recognize these signs and not fall into the debt trap.

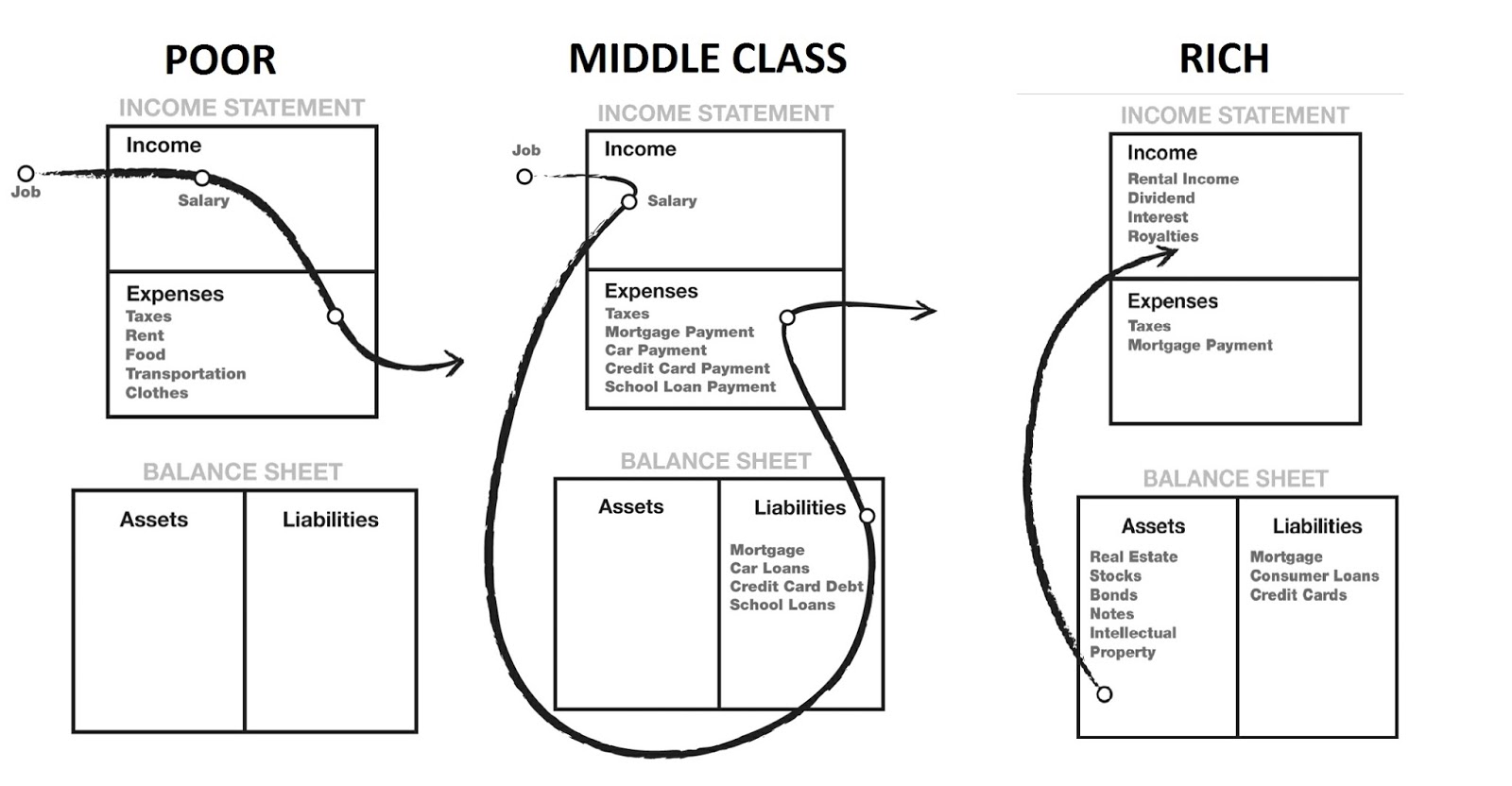

This chapter was a little tricky to follow at first because most of us have been raised on the left side of the quadrant. We see our parents and grandparents and all of our friends in debt their entire lives and assume “that’s just the way that it is..” I was in that mindset for years. “Oh, it’ll only be $199/month for that new car! That’s cheap! I can afford that.” The dealership then “owned” me for the next 5 years while I was paying that car. They got the monthly cashflow into their account each month while it left mine, never to return. The balance sheet (below middle) is how most I live month-to-month. My job pays me a salary. Then I pay my liabilities and then my expenses. “Hopefully” I have a little month after that to save. I am starting to slowly incorporate some of the things from the balance sheet (below right). I am starting to accumulate some stocks that are growing and paying some dividends. I am also looking for real estate that will pay me rental income. As this starts to happen, I will begin moving more into the I-quadrant! Remember, this does NOT happen overnight. I have definitely made my mistakes as a speculator instead of an instead. I was using my eyes and especially my EMOTIONS when making investment decisions. I am continuing to work on using my mind more consistently. It sure sounds easy, but the allure of a fast dollar is very appealing to most people!

PART 2 – The Cashflow Quadrant

Chapter 7 – Becoming Who You Are

Moving from the left side to the right side of the Cashflow Quadrant requires you to change internally. Mr. Kiyosaki believes “for some people the process is easy. For others, the journey is impossible.” This chapter focuses on what changes you must undergo to move quadrants. Rich dad always told him that money was a drug. People are addicted to the way that they EARN money. Once you have become accustomed to working at a job for money, it’s very hard to break away from that pattern. Today, money is necessary for survival. Food, shelter, and even water cost money. When you begin the process of trying to “switch sides”, the E-quadrant part of you will fight back because the part of you that wants security will fight the part of you that wants freedom. Mr. Kiyosaki continues by stating that if you are working to move to the B quadrant, you must build that system around your passion. Your passion will allow you to move past your fear. If you don’t possess the passion or lose it before your system is created, the fear part of you will drive you back to the left side of the quadrant. Most people believe that the left side of the quadrant is more secure, but that is actually not correct. On the left side, you are at the mercy of your company or profession. Your job could be cut or down-sized at any time. Your compensation is determined, not by you, but by someone else. The fact is that the right side of the quadrant is more secure, BUT it requires you to be able to read numbers and understand finances. Even during a market crash, a smart stock investor still knows how to make money. The inexperienced or uneducated person panics and loses most of their invested money.

Next, Mr. Kiyosaki points out that people on the left side pay to take risks while those on the right are paid to take risks. It sounds strange, but think about a person that invests money in a business by buying their stock. The person that pays for the stock is taking the risk of the stock going down. They are paying to take a risk. Now think of a health insurance company insuring you. They don’t pay you to take that risk, you actually pay them when they are taking the risk. Understanding numbers is the key to moving to the right side and acquiring freedom. The phrase “Get Rich Quick” is both true and false. You can move quickly on the right side to get rich, BUT you can’t take shortcuts. You must study and learn about the ideas and concepts of the right side to grow your wealth.

This chapter didn’t make much sense to me when I first read it. Like young Mr. Kiyosaki, when “Rich Dad” told him that people on the left side pay to take risks and those on the right get paid to take risks, it wasn’t clear to me. I completely fit his narrative of being afraid to move from the left to the right side of the quadrant. I have been an E for a long time (20+ years). The thought of leaving the security of my job is terrifying thinking about all of the bills and people that are dependent on me for my income. But the more I thought about it, the more I realized that I have to pay to take risks all the time! The TA and I have talked about our investing on this site quite often. I felt like we were at the Level 4 investor stage, but now I think we might be more at Level 2! When he talks about true investors make money even when the market goes down, not us… We are at the mercy of the market because we don’t truly know how to take advantage of when a market turns and starts to drop. I took this to heart and am starting to learn about how to make money in a falling market.

Maybe the toughest pill to swallow in this chapter was Mr. Kiyosaki’s points on teachers. I didn’t include these in the “official” review above, but I wanted to include them here. He feels that our current education system strongly discourages people from going into the right side of the quadrant. We stress rule following, job security, and structure in our current educational model. He strongly believes that schools should focus more on creativity, problem-solving, and cooperative tasks. I believe that we are moving in that direction, but change never comes as quickly as people would like. He even believes that teachers can be rich. YES!

So you’re saying there’s a chance….

Chapter 8 – How Do I Get Rich?

Mr. Kiyosaki really compares this to the childhood game of Monopoly. In that game, the best way to win is by building four green houses on a property and “trading up” for a red hotel. This is how he made his fortune. He bought small properties with his money and then “traded up” for a bigger property for the cash flow. He believes that doing what rich people do is easy. It’s not always the people that work the hardest that get rich. It’s about thinking independently and doing things differently than everyone else. It’s not what you do that needs to change, it’s how you think. He compares it to the idea of a person setting the goal of achieving the “perfect body”. They start out by going on a diet and going to the gym. That lasts for a few weeks and then they fall back into their old ways because they focus on what they have to do instead of changing their thinking. The answer always lies within you. People always try to change everything external instead of focusing on the internal.

Instead of working hard to “pay the bills”, work hard to accumulate assets. Too many people work hard and buy things that make them look rich, but they aren’t really rich. They are only trying to play the part. The Cashflow Quadrant is not about being, but doing. It’s about taking the action necessary to move from the left to the right side. It’s getting over the fears from the left side. An E’s biggest fear is leaving the security of a steady paycheck. For an S, it’s them needing to give up some control to others to expand their business. Fear of losing money is the biggest cause of financial struggle for most. Most people are afraid of taking any kind of financial risks because they don’t know how to manage that risk. That is why people who make mistakes and learn from them do better than people that are afraid to even make those mistakes. He claims that this is why so few teachers are rich because they work in an environment that punishes mistakes. He claims that people’s emotional intelligence overwhelms their rational side and keeps them from taking those chances that can turn into huge successes.

So moving from one quadrant to another requires you to be aware of your internal dialogue. You must make sure that you are controlling the emotional side of your brain by using your rational side to make your money decisions. You have to move past the idea of “playing it safe” and moving to the doing. There is going to be winning and losing. That’s part of life. It’s being able to handle that losing and learning from it to improve your chances next time that will help you in your journey to riches.

This was another hard chapter to swallow because again Mr. Kiyosaki points out how our current education system punishes those that take chances. He also shows how many of the most successful people in history struggled in traditional educational setting and flourished once they got into the real world. I find myself CONSTANTLY saying to play it safe and don’t take chances and then when I do finally jump in and take a chance, I do it solely on emotion and not financial intelligence and I end up getting burned! As a teacher, the biggest point most of us make about being an E is our job security. We are still fortunate enough to have a pension once we retire, and that carrot in the future makes it VERY difficult for the emotional side of our brain to let go. It’s secure. It’s safe. It’s a “can’t miss”. But is it really the thing preventing us from taking calculated risks with our money and becoming financially free? That’s a question I ask myself on a regular basis…..

Chapter 9 – Be the Bank, Not the Banker

As much as the previous chapter focused on the “be”, or mental part of building wealth, this chapter focused on the “do”. The chapter starts out talking about the Wall Street Crash of 1987. Many people forget that the lead up to that crash was the Tax Reform Act of 1986 that caused many E and S quadrant people to lose the tax breaks that they used by investing in real estate and other limited partnerships. The government took away from those quadrants, but the B and I quadrants were largely left untouched. Individuals on the left side of the quadrant were hurt badly in that crisis and many on the right gathered in much of that wealth when real estate prices plummeted and companies downsized increasing the prices on their stock. He claims it was the “best of times” for the B’s and I’s, and the “worst of times” for the E’s and S’s. Those on the left side of the quadrant reacted with their emotions and fears of not having enough money and didn’t have the financial knowledge or systems set up to take advantage of the huge opportunities.

E’s and S’s are always looking for someone to blame or conspiracies as to why they “system is rigged against them.” Yes, the system is set up in a way that does favor the right side over the left side of the Cashflow quadrant. The key idea he points out is that it’s on us to use that system the same way that a B or an I uses it to their advantage. At that time, Mr. Kiyosaki decided to invest in real estate. There are five reasons he lists, but the one that he describes in detail goes along with the title of this chapter. It gave him the chance to be the bank. It was a fairly simple process. He would find a good deal by finding a house that was for sale for $100,000 and negotiating the price to say $80,000. He would put $10,000 down and get a mortgage for the other $70,000. Then he would advertise the house for sale at its appraised price and use the magic words, “Low Down Payment. No bank qualifying. Easy monthly payments.” He would sell the house on a lease-purchase agreement and then register with a title and escrow office. They collect the payments, which are then sent to him. Now, if that customer defaults on their payments, he forecloses and then sells it to the next person who wants those “easy monthly payments.” He’s basically created $30,000 in his asset column for which he is paid interest just like a bank! The best part is that he didn’t have to save up the $30,000. He created with his mind by finding a great deal! That $30,000 was also created tax-free! How long would it take an E to save up $30,000 to earn interest on? 2 years? 3 years?

One of Mr. Kiyosaki’s biggest lessons that “Rich Dad” taught him was, “Be careful when you take on debt. If you take on debt personally, make sure it’s small. If you take on large debt, make sure someone else pays for it.” This is where real estate really shines. You invest in a property and then your tenants pay off your mortgage. He recommends that people start in the B quadrant before moving to the I quadrant. It teaches you the business sense to make smart decisions. He believes that people should start small. “The only difference between and $80,000 deal and an $800,000 deal is a zero.” It’s all about learning the process and developing your financial intelligence. Remember, the tax code is geared to favor the right side of the quadrant.

This is another gut-punch of a chapter. Basically, Mr. Kiyosaki is saying that the system IS set up to favor the right side of the quadrant. He admits that in 1986, it started the largest transfer of wealth from the poor to the rich, and it is still continuing to this day. It pisses me off, but really, the only way to fight against that system is to take advantage of those same rules to help ourselves. One of my biggest goals is to buy real estate and have tenants pay down my mortgage. I currently have my eyes on a couple of properties in my small town. I’m really stuck in that “analysis-paralysis” stage though. It’s that emotional side of my brain telling me to play it safe. I know the risks, I’ve read the books, but I have to take that step and take advantage of the tax breaks that go with owning real estate. I know that I can depreciate the houses and write off much of the income. It’s about taking action and moving myself into the right side of the quadrant.

Part 3 – How to Become a Successful B and I

Chapter 10 – Take Baby Steps

This chapter more clearly lays out Mr. Kiyosaki’s advice from Chapter 9 when he says to start small. Too many people set massive goals and then realize that it is too much and end up giving up. He believes that more important is the idea of taking small steps and working consistently in the right direction over time. This is not something that you can do in one week. It will take time. It will take emotional learning and baby steps for six months to a year. You have to learn to walk before you can run. There really isn’t a get rich quick plan outside of buying a lottery ticket!

He claims that too many people are paralyzed by the fear of making mistakes that they are trapped in their quadrant. He believes in the Nike slogan, “Just Do It!” Unfortunately in schools, we are taught to not make mistakes. This causes many highly educated people to be afraid to make mistakes and they do not take action. This is why he believes that action always beats inaction. Even if that action results in a mistake, you have learned and know what not to do next time. He also talks about setting goals. Not just setting those long-term goals, but writing them down and looking at it systematically and how you can achieve it. Look at the steps needed to move toward that goals and break them into manageable day-by-day and week-by-week steps.

Finally, he believes that everyone needs to fill out a personal financial statement. It will help you get a clear picture of where your finances are today. He believes that by understanding where you are currently, you can look to what areas you need to improve your financial position to better equip you to move forward on your path to moving to the right side of the quadrant. He closes with his financial board game CASHFLOW. This game teaches you how to move out of the day to day rat race and earn your financial freedom.

Just like in the previous chapter this one really hits me with the idea of where I am stuck in inaction. Mr. Kiyosaki even brings up the term analysis-paralysis. His idea that many highly educated people get stuck in that zone because of the fear of mistakes. I don’t think I’m a genius in any way but I do consider myself pretty financially literate, and I just feel like I’m paralyzed by fear of moving forward with one of those rental properties. I have actually played his CASHFLOW game quite a few times. You can play if for free online. It feels exactly what my day to day life is. Whenever you start to get a little bit ahead and want to take that next step, a big gut-punch in the form of say a broken water heater hits you for $2,000. And yes that just happened to me yesterday. Dammit….. Getting out of the rat race by developing other sources of cash flow would definitely relieve much of the day to day anxiety that I feel about our finances. I’m sure many of you can relate to that same feeling….

The Seven Steps to Finding Your Financial Fast Track

Step 1: It’s Time to Mind Your Own Business

Too often we are taught to mind everyone else’s business and we ignore our own. We work at jobs for employers and we make them rich. It starts in school when you are told to go to college and get a good job. People that follow this advice become E’s that make their employers rich. They become debtors that make their banks rich. They become taxpayers that make the government rich. They become consumers that make companies rich. Instead of going on their own fast track to financial freedom, they enable others to find their fast track. The first step is to fill our your personal financial statement. Use this statement to set financial goals. Set a one-year goal and a five-year goal. These goals must be realistic and attainable or you will give up easily.

I’ve definitely concerned myself with making sure that others are paid before myself. I have always been one to pay all of my bills on time. My credit score is an indicator that I am a responsible consumer. But there is the problem. I have always been a consumer! I’ve made lots of money for those companies whose bills I paid! I have done a good job of getting my financial statement written up and trying to improve my asset column and reduce my liabilities column. It’s DEFINITELY easier said than done though once you are in mid-life with kids at home.

Step 2: Take Control of Your Cash Flow

Making money will NOT solve your cash flow problems. The reason is that you were not taught cash-flow management in school. You are taught how to read, write, drive cars, how to multiply fractions, but not how to manage your cash flow. Without this knowledge, you will have cash flow problems regardless of your income level. Once you have completed your personal financial statement, you have to determine which quadrant most of your income currently comes from. Then you determine which quadrant you would like it to come from in five years. Then begin your plan. The first step is to pay yourself first. Mr. Kiyosaki says you must set aside a percentage of your income each paycheck for investments. NEVER touch that money until you are ready to invest it. Then focus on reducing your consumer debt, such as credit cards and STOP charging on them. Once you have paid them off, take any money you were using to pay them down and add that to your income you are putting into investment savings. That’s it!

I was fortunate that in my first year of teaching, one of my fellow first-year teachers got me signed up with a 403(b) rep. Even though those plans are not the best (remember, savers are losers) it was still a good step forward for me. I’ve always made sure to contribute at least up to the school match and often more than that. Just in the last 5 years, I have really focused on paying off all consumer debt. We aren’t completely debt free yet, but we are getting there. We are also putting a little money away each month for investments outside of our retirement accounts. I think this is one of the biggest problems in America. Even if you are a great contributor in your retirement accounts, you have no liquidity! You cannot take advantage of great financial opportunities that arise because all of your money is tied up in illiquid assets. Think of where most of American’s net worth is. It’s in your home and your 401(k)! More than likely, you don’t bring any income in from your home, and you can’t withdraw your 401(k) before age 59.5 without a big penalty! That’s why saving money for investments outside of those two areas is so important. I learned this by playing his CASHFLOW game online!

Step 3: Know the Difference Between Risk and Risky

One important concept mentioned to start this section is you MUST know the difference between an asset and a liability. An asset pays you. You pay a liability. You must also improve your financial literacy to realize which direction the cash flow is going. The real risk is not investing, but in not being educated in your finances. To improve in this section, Mr. Kiyosaki says you need to define what risky is to you. Is relying on a paycheck risky? Is having debt to pay each month risky? Once you have answered these questions, you need to spend five hours each week to improve your financial literacy through books, podcasts, videos, attending seminars, etc…

Learning about finance is a hugely important step for most people! Too many people just bury their heads in the sand and put money into their retirement accounts and HOPE that they will have enough money to last their retirement years. Teachers are especially guilty of this. I have news for you. Your pension WILL NOT fully fund your retirement! It won’t happen. You have to actively plan for your retirement and not just coast. You have to take responsibility for it. Remember, NOBODY will care about your money as much as YOU do!

Step 4: Decide What Kind of Investor You Want To Be

This step goes along with Part 1 of the book, but it adds another distinction to investors. Type C investors seek an “expert” to tell them what to do. These people are financially uneducated. This includes many E and S quadrant people who have been forced into investing because of changes in retirement plans. They don’t want to learn so they rely on someone else to invest for them. Type B investors seek answers. They look for answers to questions like, “What should I invest in?” or “Should I buy real estate?” These people usually make good income but don’t have time to look for investment opportunities. Type A investors seek problems. These investors look to solve problems and expect to make returns of 25% or greater on their investments. These are the Level-5 investors from part one. Mr. Kiyosaki claims that by solving problems you can get on the fast track faster, but in reality, you can be all three different types of investors at different times. If you become good at the real estate game, you might be a Type A investor there, but you will seek tax answers from a professional at tax time, so you would also be a B. If someone asked you for your best stock tip, you might say I have no idea, so you would be a Type C in that area. It all depends on where you decide to focus your learning. Mr. Kiyosaki stresses to find your strength and become an expert at solving problems in that area. It will help you reach your financial fast track more quickly. By getting on the fast track more quickly, you get the tax benefits of being on the right side of the quadrant. So to take action, start by getting educated in investing and get educated in business.

The TA and I have both really started to learn about investing and have been using this knowledge to expand on our investing. I don’t think we are quite Level-5 Type A investors yet. There is still lots to learn. I’m really learning a lot about real estate as well. My goal is to become a Type A investor in that area. Which type of investor do you see yourself being? What area will you focus on?

Step 5: Seek Mentors

Mr. Kiyosaki states that mentors can help you get on the financial fast track. The key is to find positive and not negative role models. If you want to become an expert in real estate, find someone who has done what you would like to accomplish. BUT, he said to pick your mentors wisely. He said you can learn from those that succeeded, but you can also learn from those that failed. He says that you need to take inventory on the six people you spend the most time with. He believes that these people are your future. You will end up on the same path that they are. Once you have that list, you have to list the quadrants that they operate from. Each person can have more than one quadrant listed. Then list each person’s level as an investor. Finally, place each person’s initials in the Cashflow quadrant. Then put your initials in where you are. Then put your initials in the quadrant you want to be in. If they are primarily in that same quadrant, you are probably happy, but if they are not, you need to evaluate where you are headed and if any changes need to be made.

This step really made me think. I look at who I spend most of my time with and very few of my friends have any interest in real estate and investing. I have noticed that I have become the “friend” that people come to for knowledge about investing money. Am I going to become like the 6 people I spend the most time with, or can I be the one who others turn into? The TA and I both are constantly bouncing ideas off of each other. Sometimes we are in agreement, other times we aren’t. I do have one friend, not close, who is deep into the real estate game. He has given me advice in the past, but I need to improve that friendship to get more tips and pointers. I have been to our local real estate investor’s meetings in the past, but I need to be more consistent and get more involved.

Step 6: Make Disappointment Your Strength

This is a major sticking point for people getting started. They are afraid of being disappointed or being rejected. You must expect to be disappointed. Most people turn disappointment into a liability by saying, “I’ll never do that again.” Learning from disappointment is the same as learning from our mistakes. Being prepared for disappointment allows you to prepare for the mental and emotional surprises that will arise when things don’t go your way. The key step here is to make mistakes! You learn from those mistakes, but that is also why you start small so you make small mistakes along the way. Finally, he says the biggest key is to TAKE ACTION!

I know that this is a major area of weakness for me. I am VERY afraid of making a financial mistake that could ruin my financial security. Fear consistently drives my decisions. I need to move forward with SMALL STEPS and make mistakes along the way. I think I have made some of those small mistakes with some of my investing in the market. I’ll be writing a post on that in the future!

Step 7: The Power of Faith

The final step is about looking in the mirror and telling yourself you are good enough. There are going to be doubters all along the way of your financial journey. You are going to be doing things that others are afraid to do, and they will surely question why you are doing it in an attempt to cast doubt on your ability. You must learn to believe and trust in yourself. Money does not stay with people who do not trust themselves. Take action, believe in yourself, and start today!

This chapter fits with the previous one in that I have to have confidence in the learning that I have done and take action on my thoughts. Come up with a plan and execute it!

In Conclusion

In this final chapter, Mr. Kiyosaki restates the idea of coming up with a plan, starting small, and taking action. It is not an easy process and does not happen overnight. It will take work, but by taking the time to learn, you can set up streams on income to set you up for life.

This book is an excellent read for people that want to understand why the wealthy seem to work less than the poor. Yes, the rules are set up to benefit those that can afford to influence those that create them. Instead of complaining, let’s find ways to use those rules to our advantage! While it has been a sobering experience reading through this book, I think there are a lot of positives to take away from it. Seeing the big picture of the financial system is enlightening but also disappointing. In our journey of understanding how this whole thing works, we have discovered the upper 1% are able to write a lot of their own rules ensuring the transfer of wealth from the 99% to the 1%. While this is depressing, it’s important to be educated. As we learn the rules of the financial system, it gives us understanding on how to put our own money to work for us in the future.

Get your own copy today (Affiliate Link)

Keep Stackin!

2024 MN Legislature Devastates Teachers with Pathetic TRA Pension Reform

Another Minnesota legislative session has come to an end and it’s another

2024 MN Legislative Update and How It Affects Your Teacher Pension

Another Minnesota legislative session is upon us, and it seems it’s going

Minnesota Teachers Are Angry!

Unless you’ve been living under a rock, you’ve probably heard that teaching

Budgeting, Investing for Teachers, Retirement, THE BLOG

Advice For Someone Starting a New Teaching Career In Minnesota

A few weeks ago I had the honor of presenting to a

A Perfect Time to Set up Your Emergency Savings Account

With high interest savings accounts paying out at 4.5% currently, it is

Budgeting, Debt, Money Hacks, THE BLOG

Get Out of Debt Fast Using the Snowball Method!

Debt – The Facts Debt is quickly becoming a crisis in America,

Leave a Reply

You must be logged in to post a comment.