As the new year starts it’s time again to evaluate how much of your paycheck you are saving and investing. For most of us a new school year means moving to a new step on the pay scale. I always think this is the best time to increase your contributions to your saving and investing. Personally, I always try to adjust my savings so that my take home amount stays close to the same each year. I find that is the best way for me to avoid the life style creep that comes with increases in pay. But as you adjust your auto-investing and savings where should that money go? Here are the 3 types of accounts I have found work the best for myself.

1. 403b or 457 plan.

We have covered both of these types of plans before but both are plans you have set up through your employer and your contributions to these accounts come out pre-tax, lowering your taxable income. It is a great idea to increase your monthly contributions to a 403(b) or 457 plan each year. It doesn’t have to be by much, sometimes mine is only a $20 increase a month but that is still slowly stacking those tens into an investment account putting more of those dollars to work for you creating more assets. Typically, to increase your contributions you must contact payroll at your school so they can take that money out pre-tax. It’s a pretty painless process, I do it annually.

HSA is a strange one but can be an unorthodox investing tool. Building up your cash reserves in an HSA account can be a wise investment strategy. It is money that is never taxed and will be useful down the road as medical expenses can potentially increase. Your HSA might be throug your bank collecting a small amount of interest, however it is also possible to transfer that money into an investment account to put it to work for you. Once again this is money that is never taxed however the current annual max contribution is $3650 for single and $7300 for family. Once again this will be a conversation or an email to payroll at your school to get the changes made.

I’ve always been a fan of Roth IRA’s, probably because it was my first experience in investing. A reminder, Roth IRA contributions are post tax and you most likely manage these yourselves. Roth IRA’s differ from 403(b) type plans in that they are taxed up front then you can get that money tax free once you turn 59.5. 403(b) plans are the opposite, taxed at the end not upfront. I also enjoy Roth IRA’s because you have more control and more access to your money in that account typically. Once again there is an annual max contribution of $6,000 currently.

I would highly recommend increasing your contributions to each of these three types of accounts. They all serve a unique purpose and are all good investment strategies. There are many different opinions on the order in which you should invest in these. Many suggest the order that I have listed above however I find it comes down to personal preference. There are also other directions you can choose to go to invest your new income.

4. Brokerage account

You can increase your contributions to your brokerage account. I also do this annually but it make up a small fraction of my total money in the market (10%). You have a ton of freedom in your brokerage account and it can be fun and exciting to invest in one and get into buying and selling stocks. This comes with a caveat. All of your gains in this account are taxable. That’s one thing all of the amatuer day traders in the world need to understand is you have to pay capital gains tax on earnings from that account. It’s a fine place to add your new investments but you should feel confident about your understanding of the market before you dive into it.

5. Traditional savings account

There’s nothing wrong with having a traditional savings account and increasing your monthly contributions to it. You might have some big purchases coming up and want to have the cash on hand ahead of time to afford them, a very wise move. It’s also very wise to have a small cash reserve in a savings account that you can easily access. However, I do challenge you to have a goal in mind when you are contributing to a savings account. Set a number you want to have in there. Then once you have hit that number think about moving future investments into the market. in the year 2021, the average savings account interest rate was .06%. Think about that. $10,000 would earn you $6 annually. Meanwhile a low cost index fund has a rate of return of 15.9% over the past decade. Keep the cash reserves that you need to have to feel comfortable, then think about put the left over money to work for you.

Those are 5 places that you can put your new raise to work for you. Which one fits you best? And I challenge you to save and invest as much of your pay bump as possible.

KEEP STACKIN!

Minnesota TRA Full Retirement Age: What Age 65 Really Means

Most Minnesota teachers hear terms like Rule of 90 or 60/30 long

Minnesota TRA Early Retirement Reduction Explained

Teaching in Minnesota has become more demanding in recent years. Expectations are

Minnesota TRA Tier I vs Tier II Explained

Minnesota Rule of 90: Complete Guide for TRA Tier I Teachers

Minnesota’s Rule of 90 is one of the most consequential retirement provisions

How the Minnesota TRA Pension Is Calculated (Formula, High-5, and Real Examples)

Most Minnesota teachers know they will receive a TRA pension through the

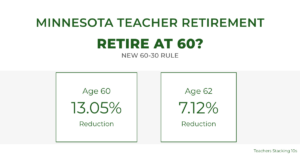

Minnesota Teacher Retirement at 60: Understanding the Enhanced 60/30 Rule

For years, Minnesota teacher retirement at age 60 was financially unrealistic for

Leave a Reply

You must be logged in to post a comment.