Debt – The Facts

Debt is quickly becoming a crisis in America, and not just at the federal level. Statistics show that the average American household carries a credit card balance of $14,241 at an average interest rate of 17.13%. That works out to $2,439 in just interest payments each year! No wonder American households are living paycheck to paycheck and couldn’t handle a $400 emergency bill.

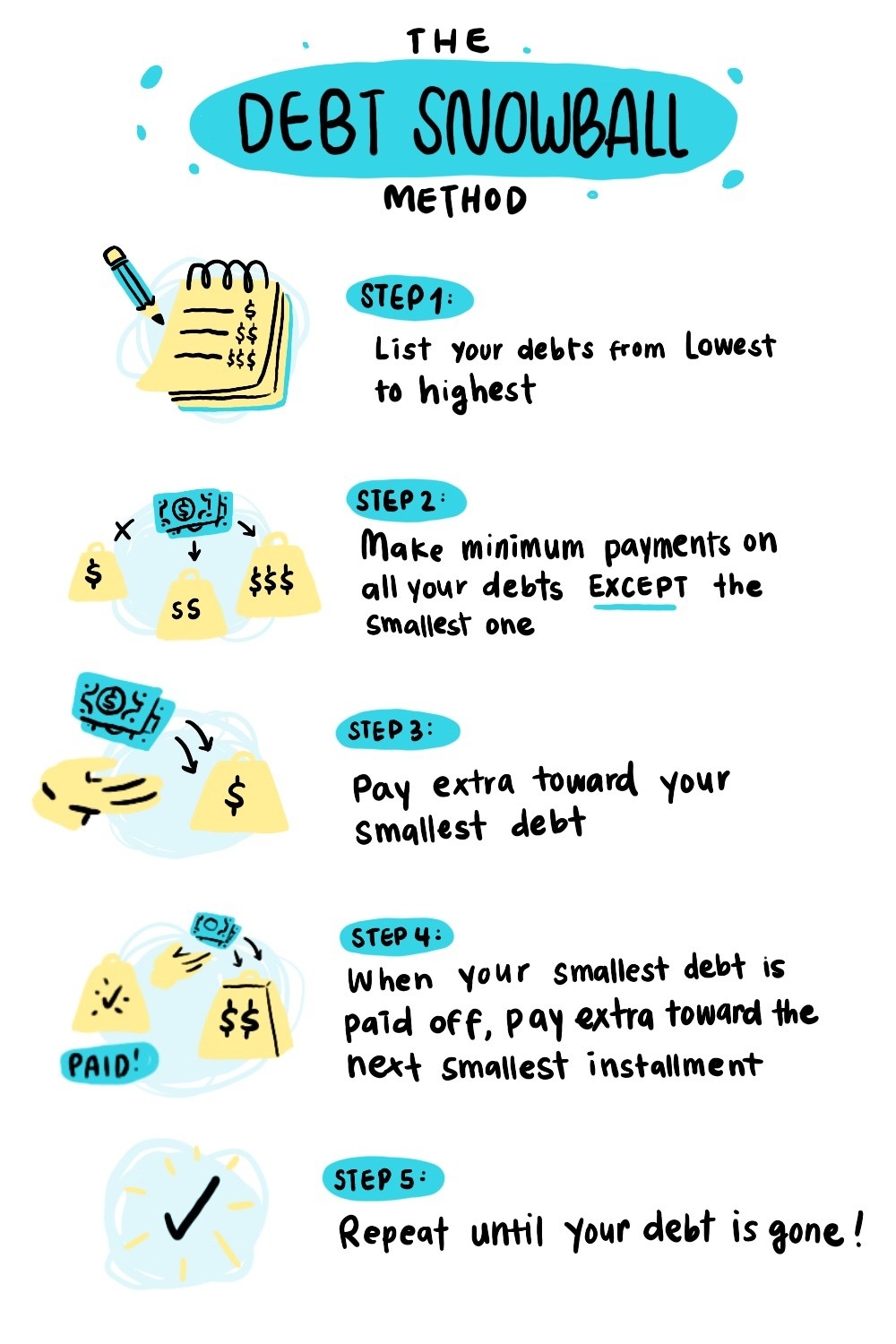

The Best AND Fastest Way to Get Out

The best and fastest way to get out of debt is the debt snowball method. This is one of the Dave Ramsey’s baby steps. There are parts of Mr. Ramsey’s methods that I don’t necessarily agree with, but I agree that consumer debt is one of the biggest issues facing the average American. With the debt snowball method, you will erase that debt and get on your way to financial freedom!

What is “consumer” debt?

This is a great question. There are many kinds of debt out there. Credit cards, mortgages, student loans, car loans, RV loans, lines of credit, the list goes on and on. When banks look at consumer credit, it is anything not backed by collateral. Your mortgage for example is not considered consumer credit because it is backed with your home as collateral.

While that is the technical meaning of consumer credit, I would like to make a couple of distinctions in that list. According to the collateral definition, your car loan or RV loan would not be considered consumer credit since they are backed by the vehicle. Here at Teachers Stacking 10s, we view vehicle loans as consumer credit because the assets they back only depreciate. Conversely, while student loans aren’t backed by any physical collateral, they are backed by your education and SHOULD increase your earning potential.

So, for this article, we are focusing on all debt outside of mortgages and student loans. The nice thing about this though is that you could easily include those if you want.

How Do People Get Out of Debt?

There are two ways that people usually attempt to pay off debt. The first one is the debt avalanche method. This is when you list out all your debts and put them in order from highest interest rate to lowest interest rate and pay them off from highest to lowest. This sounds like the best method according to math. The problem is that debt isn’t a math problem. It’s a behavioral problem. We need a method that is going to work on that behavior and emotion. That’s where the debt snowball comes in. Instead of ordering the debt according to interest rate, you are going to order the debts from smallest balance to largest balance and begin paying the smallest balance first. Then you make minimum payments to all debts except the smallest balance. You throw as much as you can at that smallest one until it’s paid off. Once it is paid off, you roll everything you were paying on that paid off debt into the next smallest debt. You continue this until you have each debt paid.

Why is This Method So Effective?

Some of you reading this are probably swearing at me right now saying, “This method will cost you more interest than using the avalanche method!” And you would be correct, but remember I said debt isn’t a math problem, it’s a behavioral problem. If your highest interest debt is also your largest debt, it might take you months or even years to pay it off. What I want you to have is a win by getting that small balance paid off. You’ll get that emotional charge and are more likely to stick with it than if you just keep paying month after month without seeing any benefit. We are in a highly addictive and I want it now society (probably the reason you are in debt!). You need a plan that is going to give you that win and allow you to see progress towards your goal.

Why Can’t I Just Roll All My Debts into One Larger Debt?

This is a TERRIBLE idea, but one that many people subscribe to. There are two reasons that this is a terrible idea. The first reason goes back to that behavioral problem. By rolling everything into one larger debt, you aren’t going to see that win of getting something paid off for a long time, possibly even a VERY long time. I want you to get those wins! The second reason is even more dangerous than the first. By rolling all those debts into a new debt, you are just robbing Peter to pay Paul. Sure, those smaller debts are all taken care of, but you have opened the door to those old bad habits and you could accumulate more debts on those open cards or lines of credit, and you could end up in an even worse position!

So, get those debts all lined up, get them in order, and start scratching and clawing your way to debt freedom. That will allow you to really get after the fun part, wealth accumulation which will be completely new to many and will allow you to KEEP STACKIN!

The Problem:

The average American household is $58,000 in debt.

The Solution:

Leave a Reply

You must be logged in to post a comment.